Doom, horrible, plunge—just a few of the words making the rounds in news headlines covering the stock market’s rocky start to the year. The reasons given for the selloff, which has since recovered some of its lost ground, tend to revolve around the slowdown in China, falling oil and commodity prices, corporate profits reverting to the mean, the strong dollar, or any number of other factors.

Should we be concerned about what the market might be foreshadowing? Or, should we resist the urge to hit the panic button? CompTIA’s 2016 IT Industry Outlook compiles data and perspectives from many sources to provide insights and guidance on the factors that will affect the IT industry, the channel and the IT workforce in the year ahead.

Channel Business Confidence

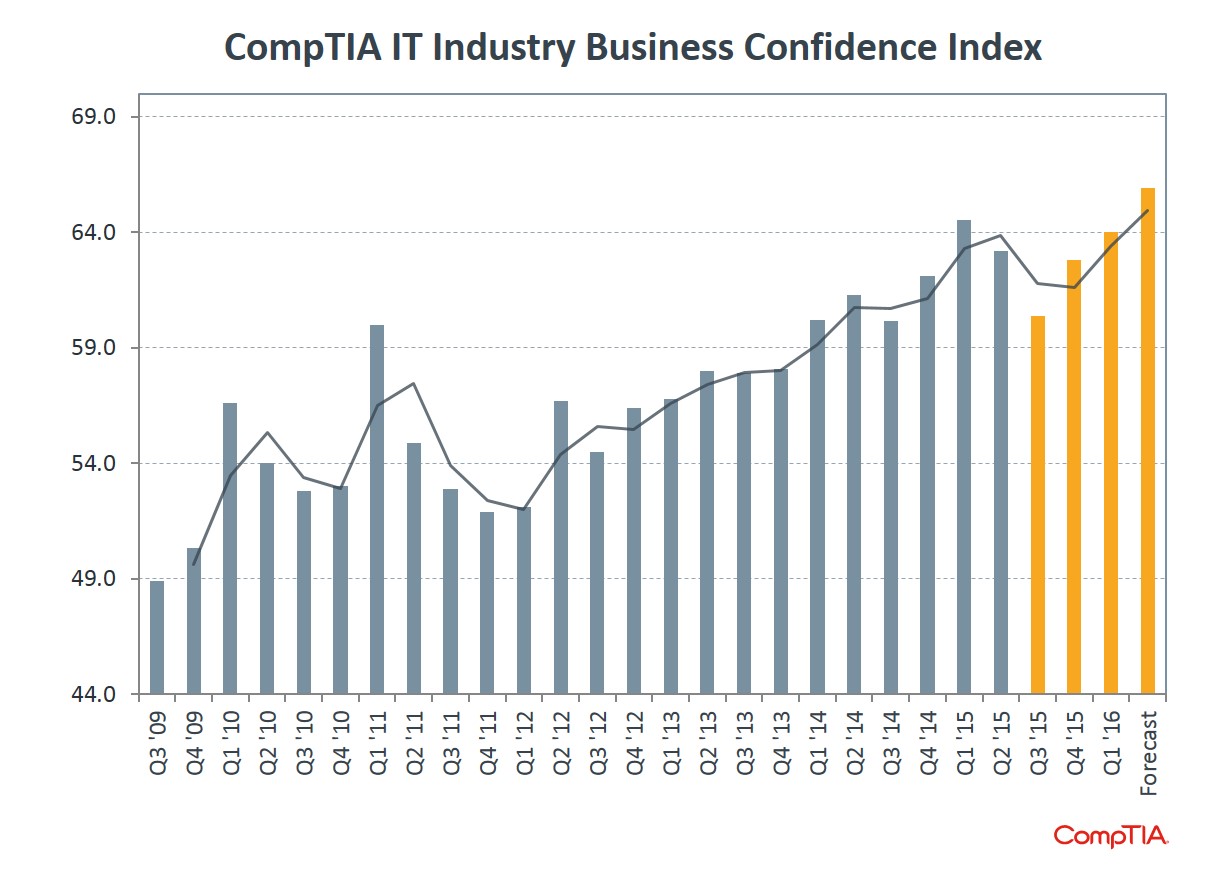

CompTIA’s quarterly IT Industry Business Confidence Index recorded an uptick of 1.2 points heading into 2016. The forward-looking component of the index suggests this momentum should continue. As reported in the State of the Channel, 6 in 10 channel partners indicated they are generally optimistic about the future of the channel, while another 22 percent see a mix of positive and negative elements.

Growth

For 2016, CompTIA’s consensus industry forecast projects growth of 4.7 percent. With favorable conditions, industry executives believe growth could push towards 7 percent. The factors most likely to contribute to hitting the upside of the forecast include reaching new customer segments, a pick-up in business from existing customers and successfully launching and selling new product lines.

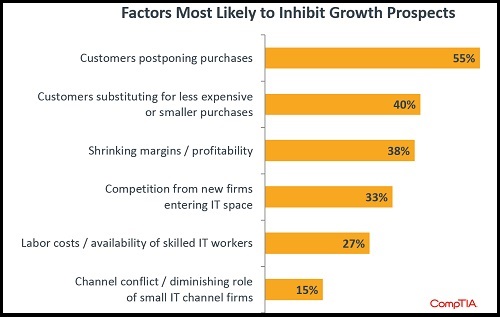

Conversely, growth could slip towards  the low end of the range (2.4 percent). Despite strong demand for IT products and services, any slowdown in the economy could result in customers postponing or possibly reducing the size or value of an IT purchase. Concerns also stem from the threat of shrinking margins or new forms of competitive pressures.

the low end of the range (2.4 percent). Despite strong demand for IT products and services, any slowdown in the economy could result in customers postponing or possibly reducing the size or value of an IT purchase. Concerns also stem from the threat of shrinking margins or new forms of competitive pressures.

CompTIA’s forecasting approach attempts to balance the opinions of large and small IT companies, as well as the opinions of optimistic channel executives with those who are more on the pessimistic side. The data should be viewed as a reference point, with some firms exceeding the average projected growth rate and others falling short.

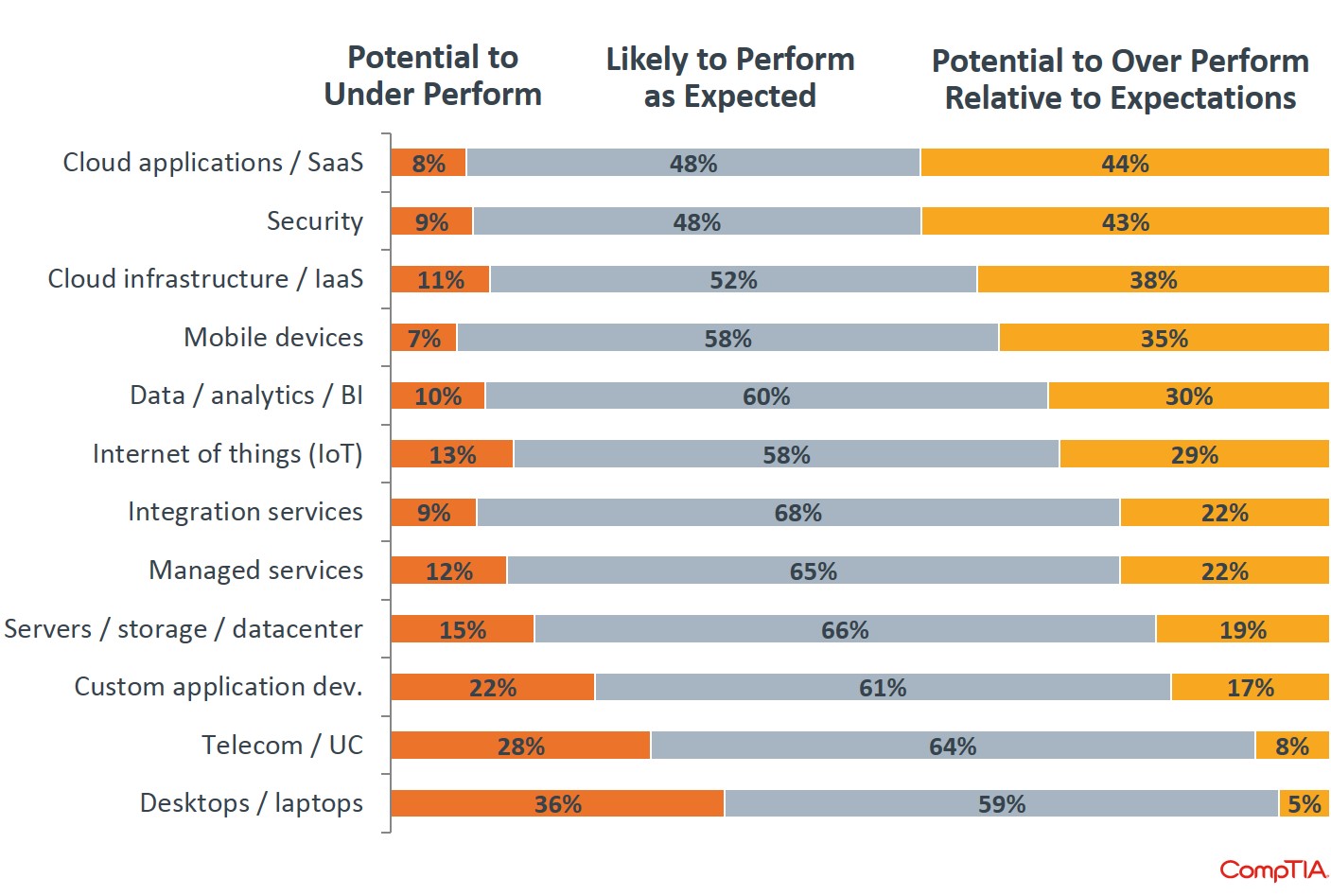

Similar to last year, channel executives are most bullish on the IT services category. This reflects the ongoing macro trends of everything-as-a-service, the proliferation of interconnected devices and applications requiring support, and cloud computing gains. With technology-driven digital business transformation now mission critical for so many organizations, expect ever greater numbers of C-suite leadership to work to ensure these strategies are fully baked into the DNA of their business models and workflows. Providers with the right mix of capabilities spanning cloud integration and support, API expertise, data expertise and managed services will all be well positioned to capitalize on this next wave of IT services growth.

For the hardware category, industry executives project relatively lower growth rates. As a revenue-based forecast, any deterioration of pricing due to commoditization will limit upside potential. Of course, this does not mean there will not be pockets of high growth product lines within the hardware category. For example, significant numbers of channel executives expect the Internet of Things (IoT) trend to gain momentum, bringing with it a renewed focus on hardware in the form of smart devices and the infrastructure to support it.

Because security now underpins every component of the IT ecosystem, as expected, growth projections are high. The security category is no longer narrowly defined in the traditional sense of firewalls or antivirus applications, but rather, as a broad suite of tools and safeguards designed to combat the ever-expanding universe of cyber threats. Forty-three percent of channel executives believe security products and services have the potential to perform above already-high expectations in the year ahead.

IT Workforce

The unemployment rate for IT occupations stands at about half the national unemployment rate. Although the 2015 year-end workforce data from the Bureau of Labor Statistics is not yet final, estimates suggest the IT workforce will reach slightly over five million workers. This translates to job growth of 3.1 percent, or nearly 152,000 additional IT jobs. If this rate holds, it will be the highest annual growth rate for IT jobs in over a decade.

As a proxy for the hiring outlook, data from Burning Glass Labor Insights indicated there were 807,450 postings for IT job openings during Q4 2015. Job postings are down from their Q3 peak, but still well above the prior year's data, suggesting demand for tech talent will continue to exceed supply for many types of skills. Hiring will be especially robust for positions in security, software development, systems analysts, IT support and data.

Bottom Line

While it is impossible to account for every variable that may affect growth prospects in the year ahead, a review of relevant data points and perspectives helps to narrow down the range of possible outcomes. Even with several economic wildcards in play, business confidence among IT industry executives appears to be holding steady. Strong customer demand for a range of IT products and services should continue to translate to growth opportunities and plenty of upside potential for well positioned channel partners.

Tim Herbert is senior vice president of Research and Market Intelligence at CompTIA.