S mall businesses are commonly described as the lifeblood of the U.S. economy. This is not hyperbole as SMBs account for the vast majority of the nation’s business entities, while serving as a key driver of job growth and innovation. Success as a small business owner means overcoming challenges on many fronts, but also embracing new opportunities in technology and business. CompTIA’s latest research explores the business relevance of technology to SMBs and the factors affecting their perceptions, decisions, and investments in established and emerging technologies. We also explore the professional services industry, taking a look at their decision to offer technology to their own customers.

Key Points

SMBs place a high priority on technology

Roughly two thirds (64%) of SMBs indicate technology is a primary factor in pursuing their business objectives, including 73% of companies in the medium category of 99-249 employees. Top SMB priorities for the year ahead – implementing new systems and processes, identifying new customer segments and markets, renewing existing customer accounts, innovation, and launching new products and services. Thirty-five percent of companies also prioritize hiring skilled workers to help them drive technology initiatives into the future.

Hardware still a priority among SMB buyers

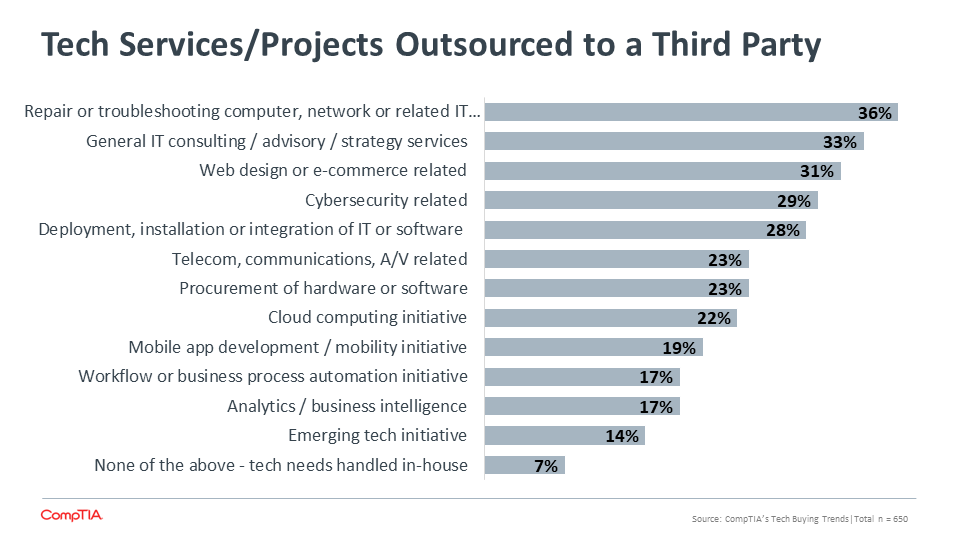

In the last two years, 36% of respondents said that their tech purchases are best characterized as focusing on core infrastructure. This means devices such as laptops, desktops, mobile phones, servers, as well as networking equipment, security software, storage etc. Despite the fact that many workloads – think storage, for example – have moved into the the cloud, companies nonetheless require the basic hardware and workstation devices that enable their employees to do their jobs every day.

Professional services firms getting into tech business

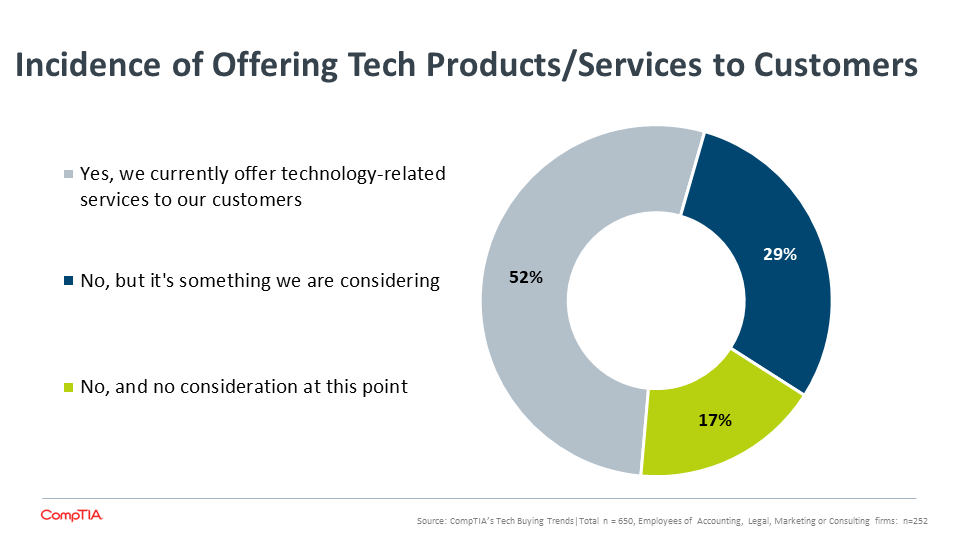

Across the SMB landscape, professional services firms in the worlds of accounting, law and marketing have been getting into the tech game. CompTIA found that 52% of these firms are offering some technology services to their customers. Three in 10 are not doing so, but considering it. More noteworthy, nearly half of respondents (45%) said revenue from tech-related activities and services is growing faster than the rest of the business, while another 43% said the pace comparatively is about the same.

Setting The Stage: SMB Market Overview

Using the Small Business Administration (SBA) definition of small business – those with 1 to 500 employees, there are approximately 6 million U.S. businesses meeting this criteria. Additionally, there are another 24 million sole proprietors, many of which could be characterized as home-based businesses. In totally, SBA reports 30 million small businesses, of which 80.5% are sole proprietorships. Given the breadth of this market, not surprisingly, the majority of Americans work for a small or medium-size business or are self-employed.

The market follows a classic pyramid shape with a substantial base of micro businesses (the vast majority of business entities at the base, and a very narrow peak of large enterprises, accounting for less than 1% of the total.) Analysis of industry sectors reveals the top four verticals to be healthcare, professional services such as accounting, retail, and construction across business establishments in the SMB space. IDC forecasts total IT spending by SMBs to be nearly $602 billion in 2018, an increase of 4.9% over 2017.

Other characteristics of the SMB market to keep in mind:

High rates of churn in the SMB space

Smalls businesses are a primary source of job creation, however, small businesses also fail at high rates – only about half of startups survive five years. With 10%-12% annual turnover,

SMBs also destroy a lot of jobs.

Small business has global impact

According to ITA, a total of 294,834 companies exported goods from the United States in 2015. Of these, 287,835, or 97.6%, were small firms; they generated 32.9% of the United States’ $1.3 trillion

in total exports.

Small businesses aren’t just staying in their lane

The explosion of cloud-based computing and tech-savvy among non-tech workers has seen a number of SMB organizations add to their bottom line with a side gig in tech sales.

Consider that 52% of professional services SMBs (accountants, lawyers, marketers) said they offered technology services to customers in the last year. This report takes a deep dive into professional services space and its flirtation-turned-relationship

with the technology business.

.png?sfvrsn=c6c67c86_2)

Before we talk tech, we need to discuss general business priorities. For most SMBs, these almost always start with the customer. Losing market share or failing to build a pipeline of new prospects is never a viable formula for long-term success. Among CEOs or presidents of SMB companies, identifying new customer segments and new markets held greatest importance as a business priority. Forty-five percent of that group cited it as a top priority. And it’s not just new customer acquisition. Another nearly 4 in 10 of total respondents also acknowledge how critical it is to cater to existing customers, placing emphasis on renewing accounts on a regular basis. Existing customers are also prime targets for new products and services.

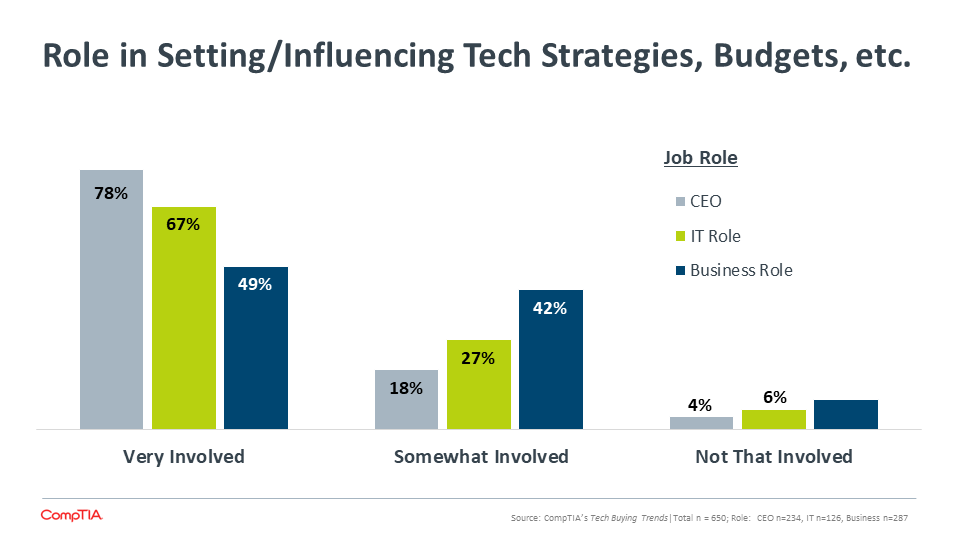

Underlying all priorities is a focus on process and efficiency, whether that involves implementing brand-new systems or streamlining and finetuning what is already in place. Process efficiency impacts all aspects of a business, from customer touchpoints and interactions, to staff productivity, to cost and revenue performance. Not surprisingly, this objective is the top priority for IT staff (48%), who are most likely take on the task. Fitting in with efficiency, SMBs also value innovation, new product launches and hiring skilled workers.

Tech In The SMB Workplace

Despite their size, small to medium-sized businesses are often just as reliant on and engaged with technology as their enterprise brethren. And while compared with larger firms, SMB organizations obviously have different budgets, staffing and skills issues, and other considerations, the majority of them deploy technology as a strategic tool for reaching their business goals. This is critical given that SMB firms comprise the vast majority of all businesses in the U.S. economy and as such are the typical customer for many technology vendors and solution providers. How they spend, why they spend and what they spend on are critical to understand.

How important is technology to the SMB ecosystem? Very. Nearly two thirds (64%) of respondents said that technology – from computing devices, software, Web sites, e-commerce platforms and operational tools – is a primary factor in reaching their business objectives. Three in 10 consider technology a secondary factor in helping to meet those goals, while just 6% describe technology as a non-factor. Not surprisingly, medium-sized organizations placed the most weight on technology as a strategic tool, with 73% characterizing it as a primary factor in meeting overall objectives. By virtue of size, this segment of SMB organizations is more likely to be dealing with greater operational and process complexity, larger staffs and customer bases, a more far-reaching geographic footprint and other factors that the application of technology can help facilitate and make more efficient.

That said, even among the smallest of SMBs, those micro-sized firms of fewer than 20 employees, technology is also essential business-goal fuel. More than half (56%) cite technology as a primary factor in achieving objectives, further proof that the reach of these tools is not confined to the largest of firms.

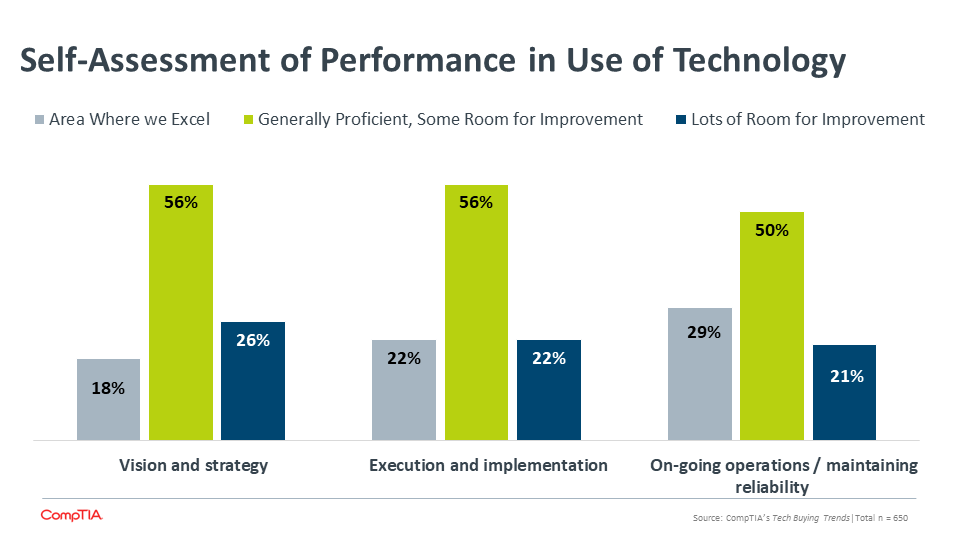

And yet, while technology may be essential for today’s SMBs, it has not gotten easier to understand, use and/or manage. Just like larger organizations, many small businesses are on the path toward digitizing their environments, using cloud-based solutions and services, and increasingly diving into data analytics to meet customer demand. But for firms strapped for resources and unlikely to have an IT staff filled with workers skilled in emerging tech and other cutting-edge tools, the road to digitization is an uphill battle. Consider the following backslide in confidence: in 2016, 23% of SMB respondents to this CompTIA study reported excelling in technology vision and strategy; two years later, for this iteration of the study, that number dropped to 18%.

SMBs also report slight drops in proficiency around execution and ongoing management of technology between 2016 and 2018. It’s not that SMBs have gotten less tech-focused or capable, but the sheer number and type of solutions has grown in such size and complexity that many firms are taking two steps forward and one back as they navigate these new learning curves.

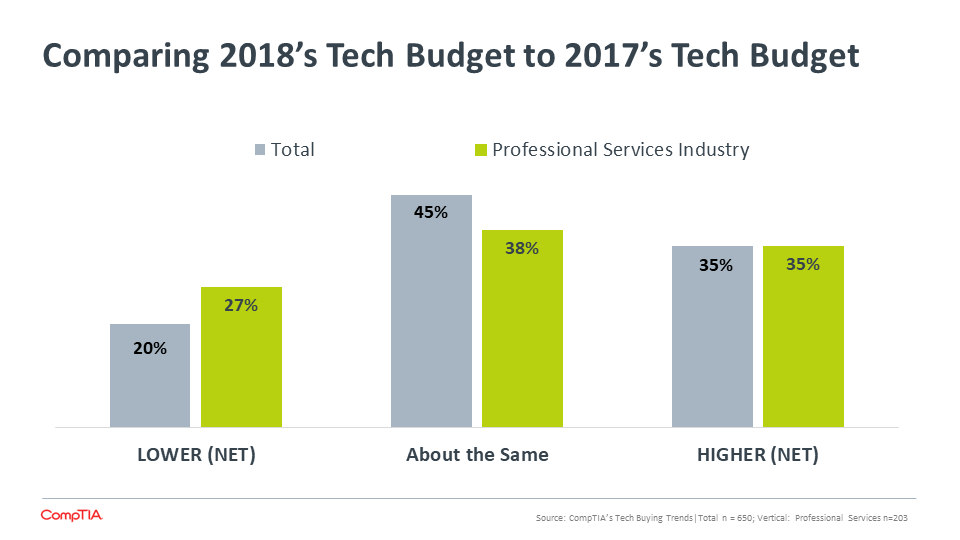

SMB Technology Budget Trends

Technology is clearly a priority for many SMB companies, particularly as a way to meet many of their business goals. Yet adopting and applying technology requires resources that for many smaller firms can stretch an already tight budget. Of course, how much a business spends on IT is not a universal formula and depends heavily on a number of factors. Consider a few of the following:

- How essential is IT to operations? Depending on the type of vertical industry your company is in, the number of staff employed, and nature of the work done, the degree to which IT is front and center to everyday operations could vary widely.

- Are you in growth mode? If your company is expanding rapidly, getting into new markets, adding staff and/or new facilities, then it’s likely that technology, especially some of the newer, emerging solutions, will play a more strategic role in your plans than a company that is not in growth mode.

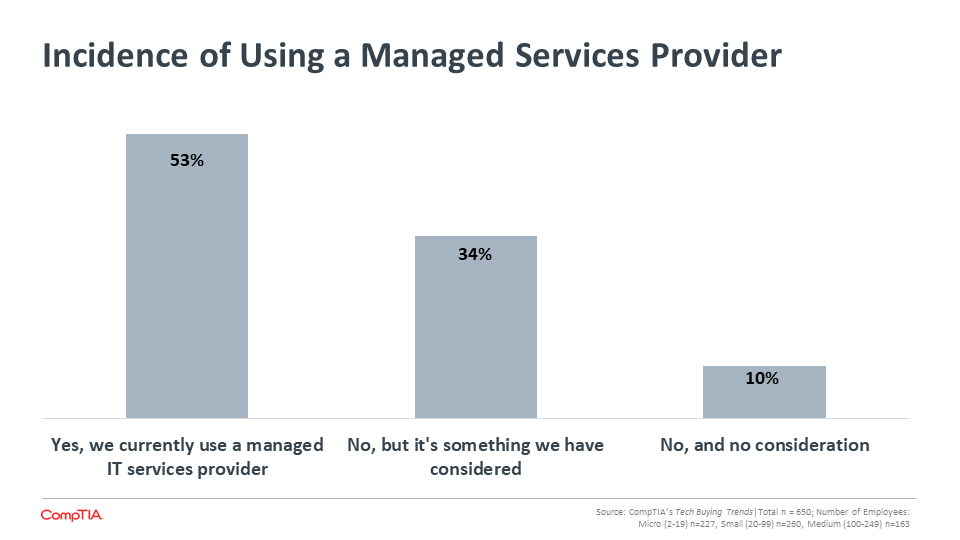

- Are you working with an outside provider? Companies that use an outside technology firm such as a managed services provider to help tend to their IT environments and purchasing needs will have different budgeting considerations than organizations that do everything in-house.

- What’s your level of risk tolerance? Many small companies are risk averse when it comes to taking out lines of credit or otherwise borrowing money. But for many small businesses to invest in new technologies and fuel growth, third-party financing is often a necessity.

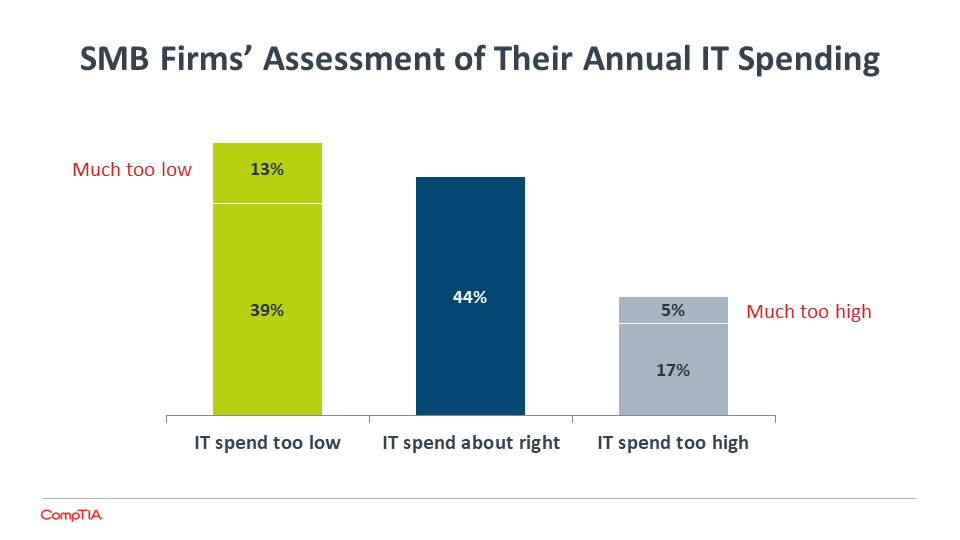

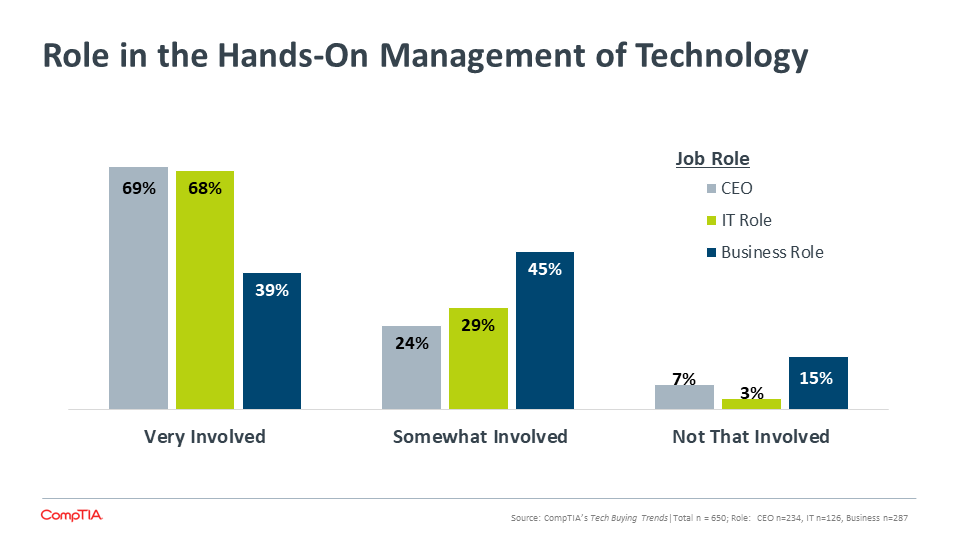

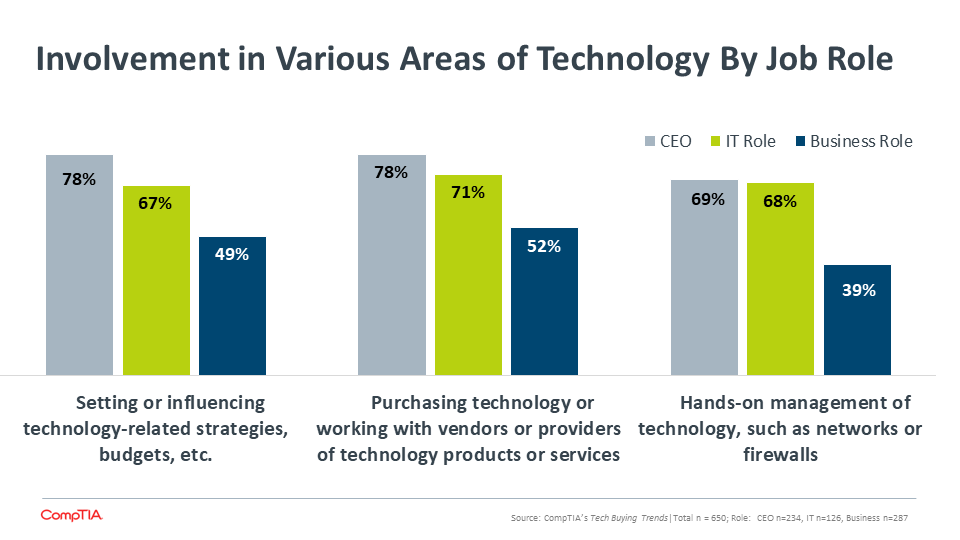

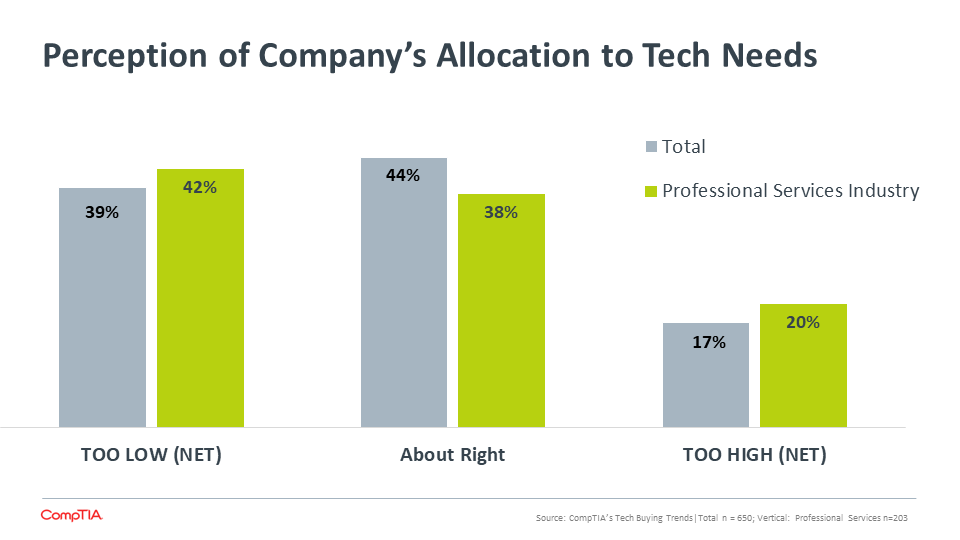

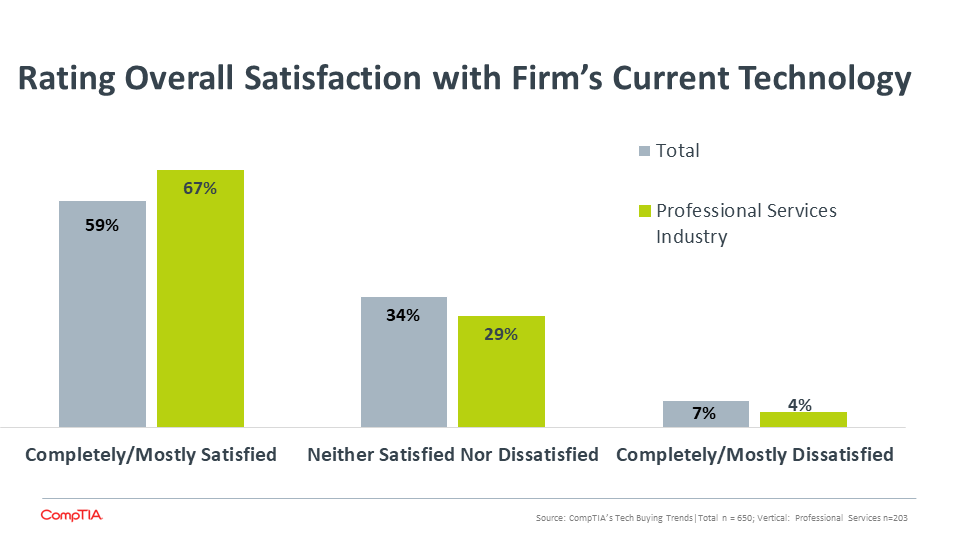

Regardless of how SMBs answer the questions above, many respondents feel their organizations could be spending more on technology. Nearly 4 in 10 respondents characterized their firm’s allocation of budget to technology spending as “too low.” Ironically, twice as many business-oriented workers (15%) than their IT-focused colleagues (7%) said tech spending is too low at their organizations. It’s hard to say why this is the case, though because IT staff may be more responsible for the technology purchasing decisions, they might be less inclined to say it is lacking in scope. On the other hand, business staff, including sales and marketing reps, might be lamenting the lack of updated devices or tools for their personal use, which is often a perennial source of friction within any organization, small or large.

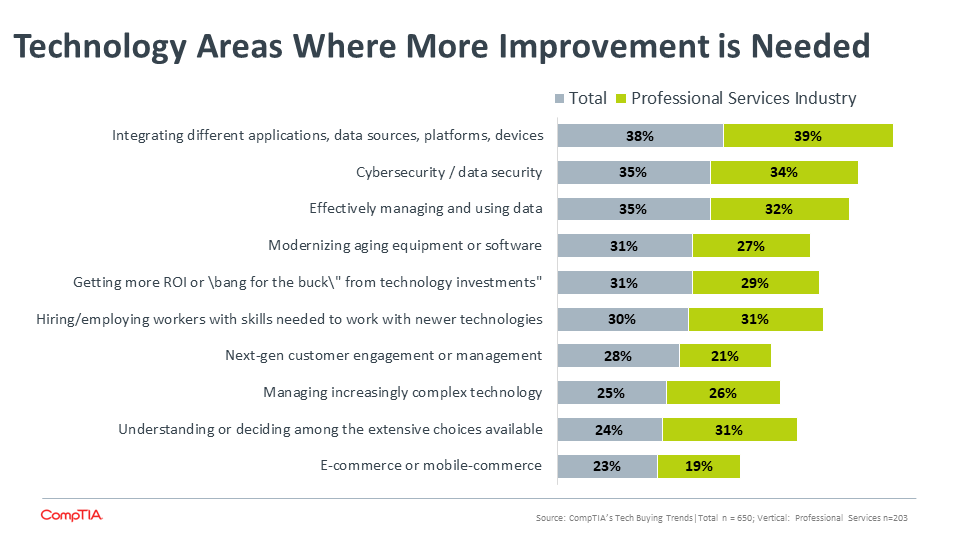

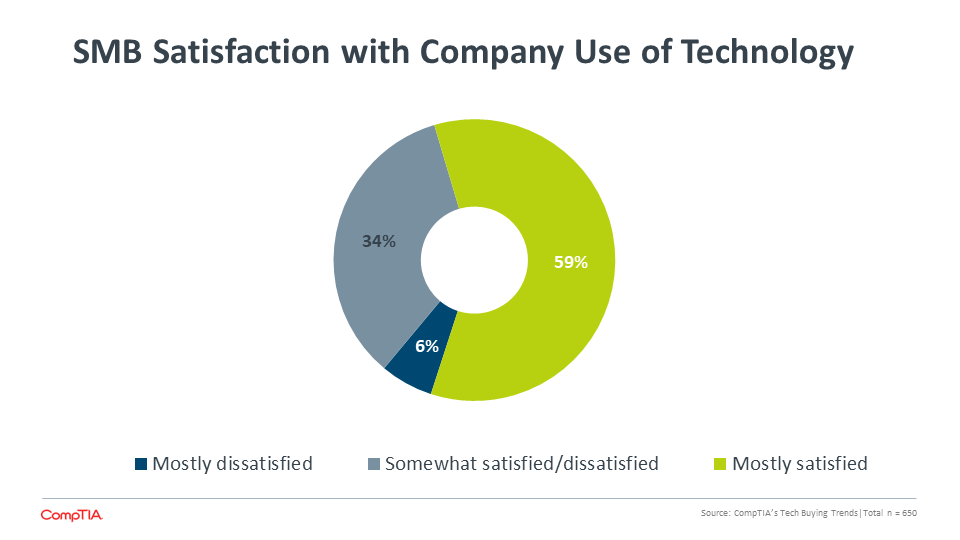

Six in 10 respondents are mostly satisfied with their company’s use of technology, which is on par with sentiment expressed in 2016. Yet they still have a wish list of items they would fund if budget allowed. Their priorities point to the growing complexity of today’s combination of new and older technologies. As they embrace a cloud-based world, many SMBs struggle to balance those newer virtualized workloads and solutions with existing on-premises equipment. Integration of applications, platforms and the use, management and security of data are paramount. The catch? This is often no minor task for organizations that may lack their own internal IT department or worker. It’s a problem often only solved by investment and added resources.

SMB Tech Purchases & Spending Priorities

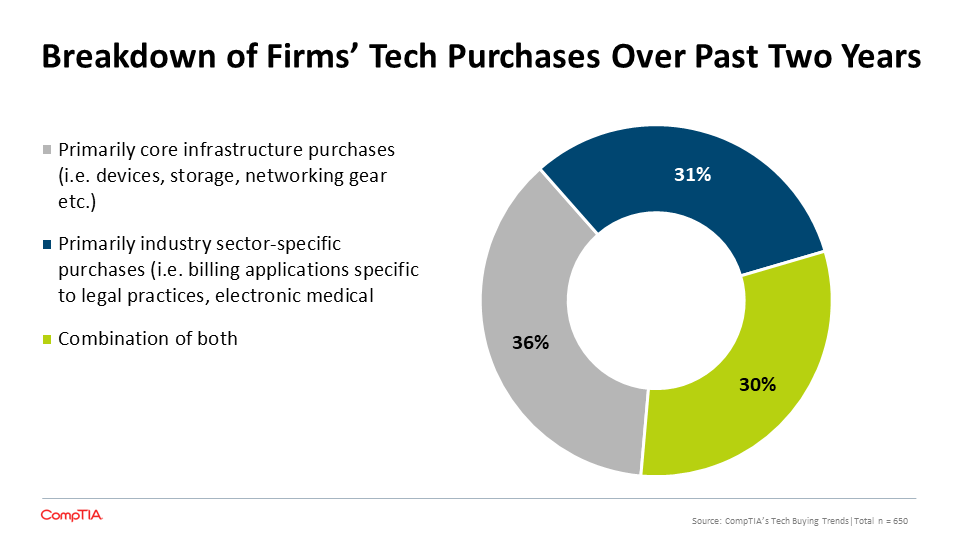

What are SMBs spending their tech budgets on? Turns out it is a fairly balanced mix of the basics along with more nuanced solutions that pertain to the organization’s particular industry. And there’s one ticket item not to be overlooked: Hardware.

In the last two years, 36% of respondents said that their tech purchases are best characterized as focusing on core infrastructure. This means devices such as laptops, desktops, mobile phones, servers, as well as networking equipment, security software, storage etc. Despite the fact that many workloads – think storage, for example – have moved into the the cloud, companies nonetheless require the basic hardware and workstation devices that enable their employees to do their jobs every day. The prevalence of core infrastructure buying was similar across the entire SMB sizing landscape, from micro-firms to medium-sized. Looking ahead to the future, a recent research study by IT social network and community Spiceworks found that many firms with fewer than 100 employees have increased their investments in hardware for this year. It will grow from 31% of IT budget allocation in 2018 up to 42% in 2019. This correlates to CompTIA’s study, which found a strong desire among respondents for new or upgraded hardware devices when asked specifically about their tech “wish list” items. It could be that smaller companies have been holding onto equipment longer than the conventional three-year upgrade cycle, and are now reaching a point where users are clamoring for some new gear.

Right up there with infrastructure, however, is spending on industry- or sector-specific purchases, typically applications and other software. Thirty-one percent of respondents said their company has been spending in this solutions area. Consider software such as a billing applications specific to law practices, electronic medical records software for a doctor’s office, or the myriad options for accounting and/or tax-preparation types of tools. Later in this report, we will dig deeper into some of the specific tech-buying habits of professional services firms such as accountants, lawyers and marketing agencies.

Further illuminating the fact that many SMBs have their feet in both the older, horizontal world of infrastructure technology and newer vertical industry solutions, 30% of respondents said their tech spending over the last two years has focused on both areas. This rings true across SMB companies in all size categories.

In terms of pure dollar-amount spending on technology, budgets clearly vary depending in great part to company size, along with other factors iterated earlier in this report. But breaking it down, the typical range of annual tech spending falls somewhere between less than $5,000 up to $249,000, with a sharp drop-off after that in the number of SMBs that spend more than that per year. Not surprisingly, micro-sized firms comprise those companies spending at the lower end of the range and medium-sized firms with upwards of 249 employees accounting for the larger outlay. Generally speaking though, a sweet spot for the entire SMB ecosystem is somewhere between $10,000 and $49,000 of spend per year.

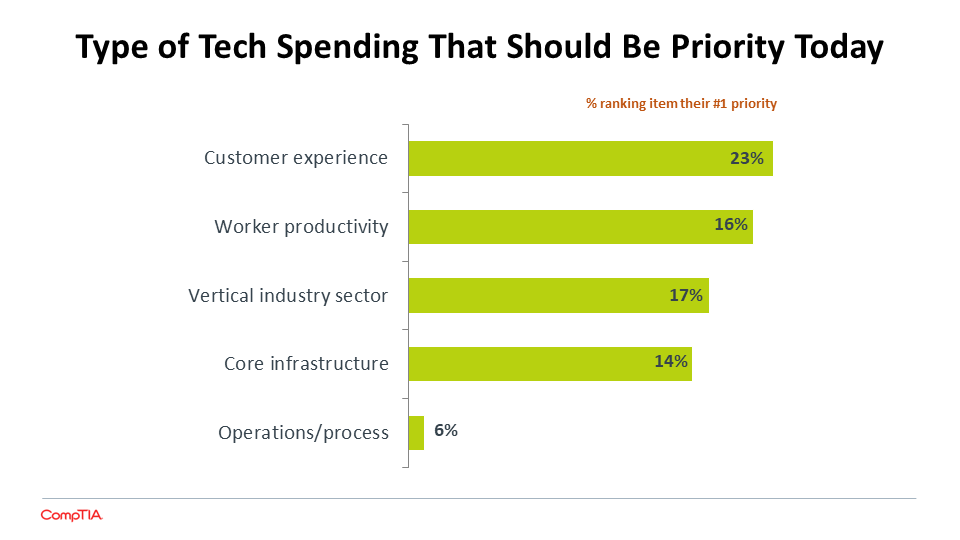

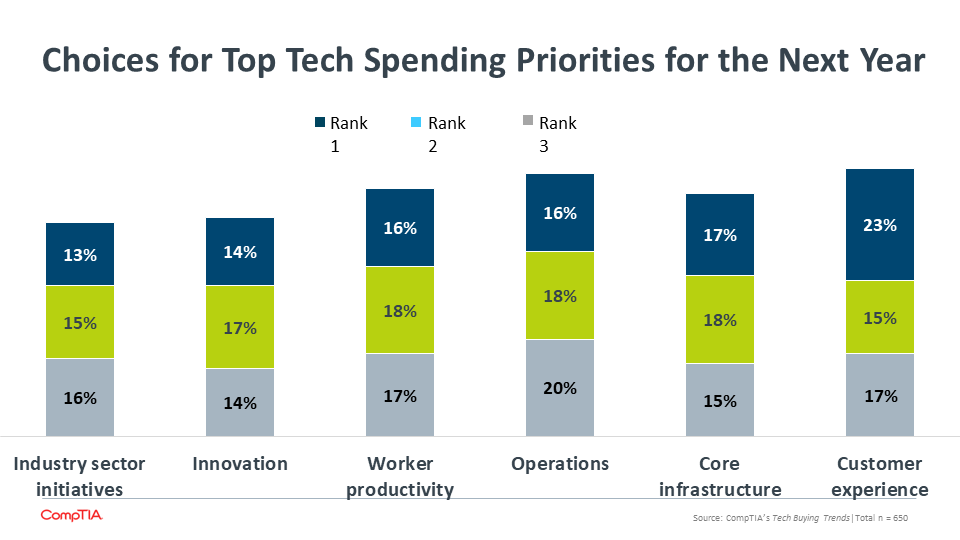

In terms of total revenue, how much is the average SMB organization spending on technology? According to research conducted by Alinean, SMBs spend an average of 7% of total revenue on technology in a given year. Based on this year’s CompTIA research, top priorities for that money focus largely on three areas: the evolving customer experience, worker and organizational productivity, and vertical industry sector initiatives.

Attention to customer experience, a much-hyped concept that nonetheless is an evolving imperative in today’s marketplace, cuts across SMBs of all sizes. As companies go through their digital transformation, it’s important that their end customers are included in that migration. So SMBs moving their internal business assets to the cloud should at the same time be considering how they interact digitally across multiple platforms/tools with external customers.

SMB Purchasing Channels

Choices are myriad when it comes to technology purchasing sources, especially in today’s cloud-based world where, for example, many applications are as simple as a credit-card entry and click away from being deployed across any sized company or department on the planet.

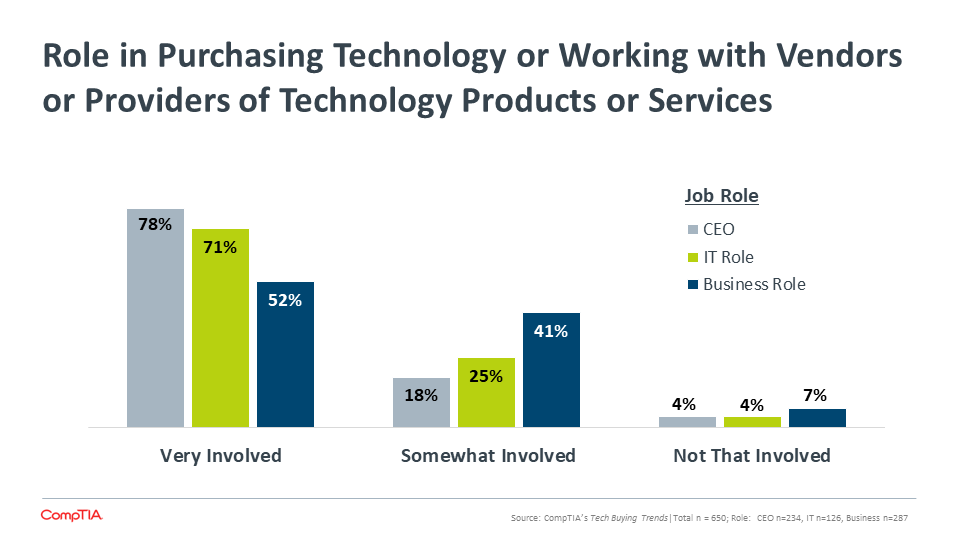

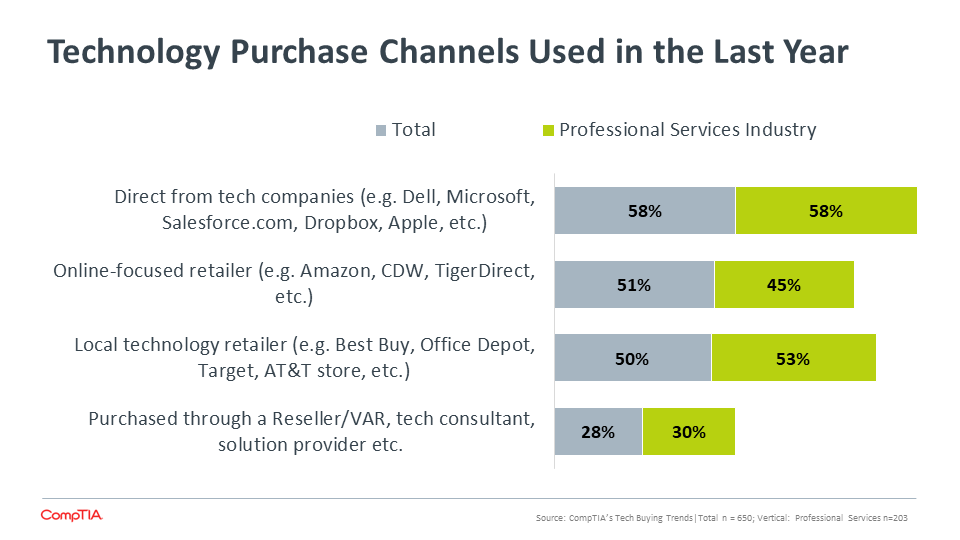

For SMBs, those options mainly fit into four buckets: vendor/manufacturer, online retailer, local retailer, third-party technology reseller. The majority (58%) buy technology directly from the vendor or manufacturer. This could be direct-ordering a hardware upgrade or, as mentioned above, provisioning a software application online from a vendor’s own Web site or marketplace. Far more of the largest SMBs (between 100-249 employees) procured technology directly from individual vendors than did smaller organizations in the ecosystem. Sixty-seven percent of these medium-sized firms used vendors compared with 57% of small- and 51% of micro-sized organizations. This isn’t surprising given that the larger firms, even in this SMB category, tend to maintain internal IT departments and procurement processes that often involve partnering directly with manufacturers, particularly when it comes to the conventional hardware upgrade process.

SMBs do spread the wealth around. The data indicates that these organizations will allocate their tech spending pretty evenly across four primary purchase channels: local retailers (26%), online-focused retailers (26%), direct from vendors (28%), and resellers or technology partners (20%). This spending breakdown mirrors closely to how SMBs distributed their technology dollars in 2016, the last time CompTIA conducted a study of this ecosystem.

.png?sfvrsn=ece62c97_2)

This makes clear that SMB companies don’t put all their eggs in one basket when sourcing technology. Most likely, they conduct due diligence in the buying process by researching prospective providers across their products and services offerings, pricing, delivery models, reputation for ongoing management and customer service and other factors that every day consumers are used to doing in their own lives. It’s a Yelp world.

Half of SMBs said they have worked with a third-party reseller/solution provider either frequently or somewhat regularly in the past year. Another 31% said they do so occasionally. In some cases, that could be an arrangement where the provider is catering to 100% of that SMB’s tech needs; in others, they are offering a single service. Or the SMB customer is simply doing a transaction with the provider for a piece of hardware or software. Just 16% of SMBs say they rarely work with this kind of firm, so while total dollar allocation might not be as high as it is on tech spending with vendors or online retailers, third parties such as managed services providers still appeal to the SMB set.

Speaking of online retailers, there is no denying the “Amazon-ification” of purchasing stuff. For SMBs, this route is particularly attractive as it eliminates lots of steps and red tape. Expect this sourcing mechanism and other online marketplaces to continue to attract SMB attention in the year ahead.

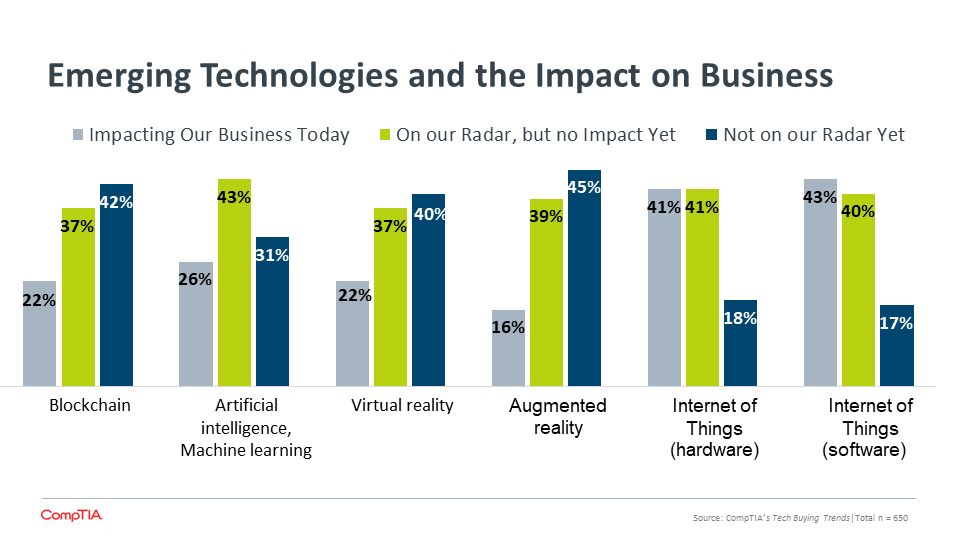

Next Frontier: SMBs & Emerging Tech

From AI to drones to internet of things, emerging technology is an unavoidable topic today – both daunting and exciting for many. SMBs are no different in their exposure to the raft of new types of offerings and solutions that are quickly changing the ways we conduct business in today’s economy. More than half (53%) of SMBs, regardless of where they are on the adoption curve for emerging technologies, say this broad category represents a positive opportunity to innovate, profit and improve productivity. That viewpoint was most expressed by organizations at the larger end of SMB spectrum (61%), which is not surprisingly given that these firms likely have more resources to have begun experimenting with more cutting-edge solutions ahead of much smaller entities.

A quarter of respondents (23%) say it’s too early to tell what the impact of emerging tech will be just yet on their business. This mirrors findings in CompTIA’s 7th State of the Channel study from 2018, which found that 29% of these technology providers remained in the experimental phase with emerging tech and that they were not yet selling to customers. Most of these channel firms, themselves SMBs, count SMB organizations as their main customers, which makes the moving in lockstep on emerging tech adoption make a lot of sense.

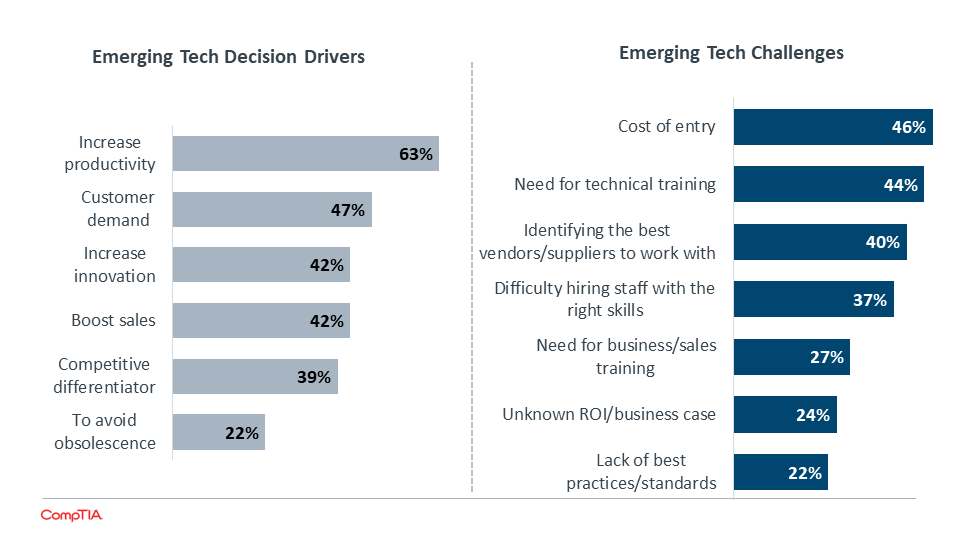

Other SMB respondents reveal the trepidation at play with regard emerging technology, or possibly any new venture. Twelve percent of respondents were lukewarm in their review, describing emerging tech as partly positive and partly negative. Even more foreboding, a full 10% gave a full thumbs down, citing the high cost of entry for many of these solutions and the potential job-security perils inherent in automation. The apprehension is understandable for some. Consider cost of entry, which is no minor speedbump for most SMB companies, especially those at the smaller end of small. It’s not just the capital outlay needed to get into a new product market or solutions space, but the expenditures needed to retrain and/or newly hire workers with skills in these burgeoning areas. Consider that 16% of respondents that said their total tech budget for 2019 would be lower than the year prior characterized emerging tech as a negative. They clearly see the cost implications.

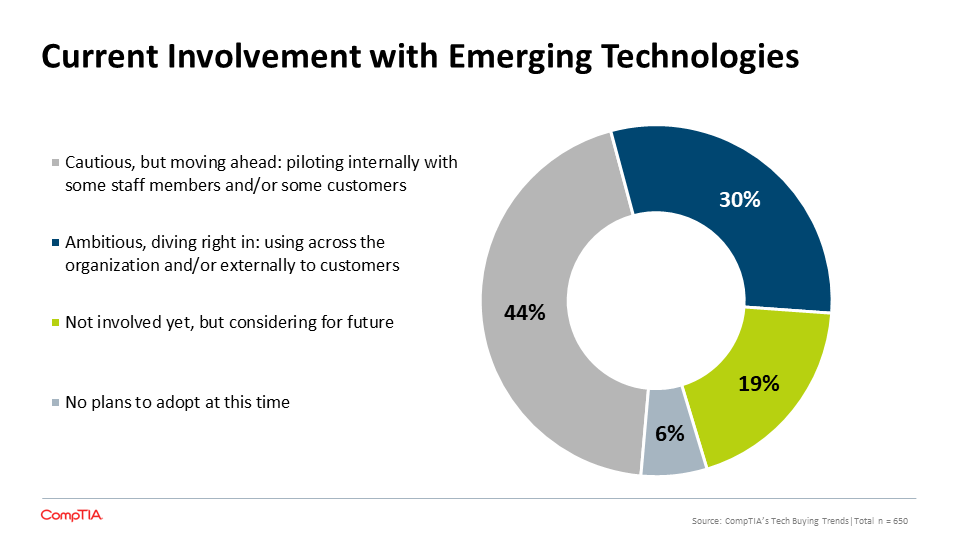

That being said, SMBs are not living in a vacuum. Whether the industry is manufacturing, retail, healthcare, professional services or beyond, most of these smaller firms are looking ahead at the advancements that will make and/or keep them competitive. Three in 10 firms are all in, describing their approach to emerging tech adoption today as ambitious. They are actively using solutions internally and externally with customers. The bulk of the sample, 44%, report a cautious slant toward emerging tech adoption, one involving pilot projects both internally and with customers. Roughly 2 in 10 haven’t jumped on board yet, but say they are considering, while just 6% say they have no plans to adopt emerging techs.

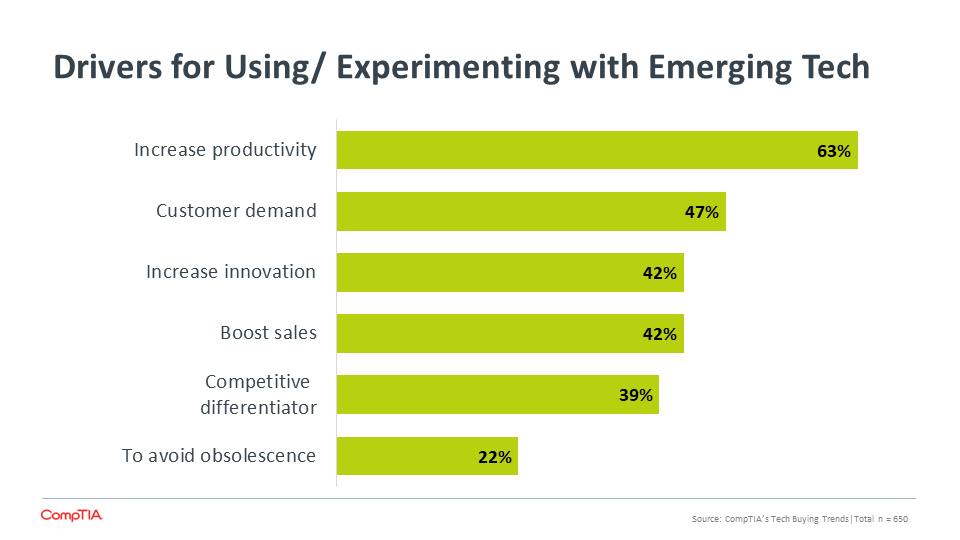

By far, the main reason to adopt is to drive productivity. Nearly two thirds of SMBs cited that as their main decision driver for emerging tech. Ultimately, they believe these tools can help them reach their overall top business priority of the coming year: Implementing new systems and processes to enhance efficiencies, drive revenue and reduce costs.

Professional Services Firms Get Into The Technology Business

Think about the technology marketplace today. There are the usual suspects selling their wares direct or online, major vendors such as Microsoft, Apple, Amazon and countless others. There’s also the enormous downstream network of tech-focused third-party service providers, resellers and distributors that push a bulk of sales and tech-related services. But that’s not all. Increasingly today, there are tech-influencers operating outside the technology industry altogether. These are firms rooted in a specific vertical industry that have developed a technology-related practice as an adjunct to their core business.

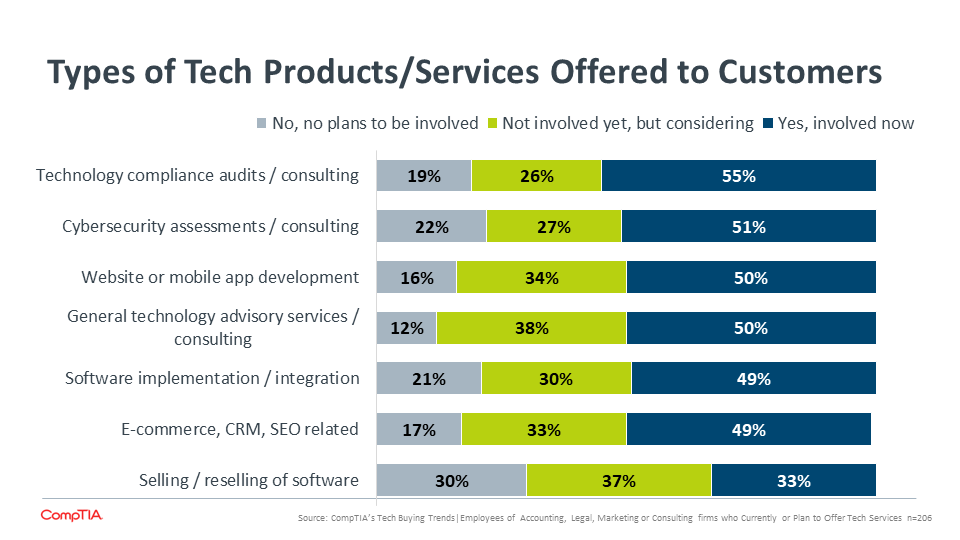

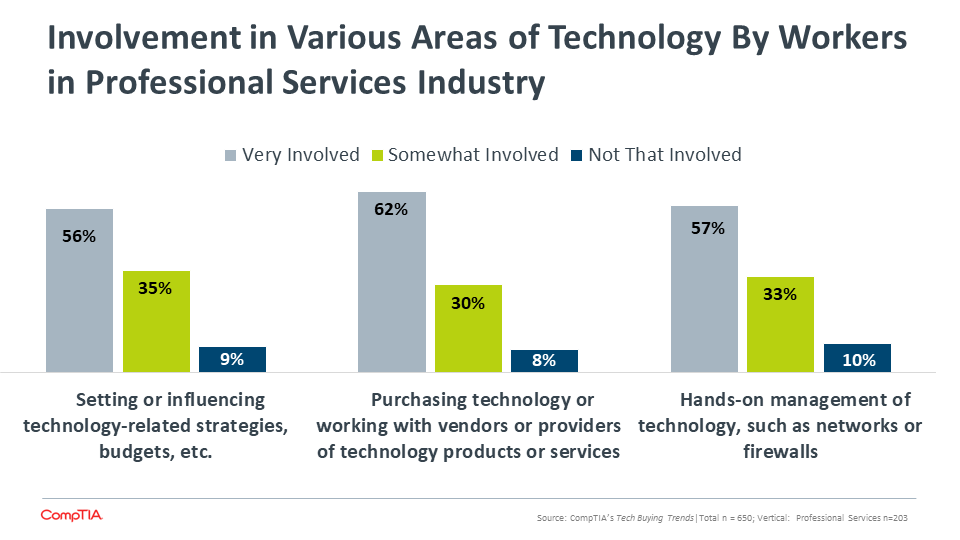

In the SMB landscape, this trend has been notable among professional services firms in the worlds of accounting, law and marketing. As longtime users of technologies focused on their industry, these firms have become de facto experts in certain IT solutions. Savvy practitioners have learned how to extend this tech expertise to their own customers. In fact, successfully launching new products and services is the No. 1 business priority for this sector this year, with 67% of respondents saying technology is a primary factor in reaching their goals. As a recent blog in Accounting Today, an industry publication, put it: “The most important thing… to remember is that technology becomes part of the products you sell. This is a totally different way of looking at technology in a CPA firm. In a traditional firm, technology is a tool or piece of overhead. In today’s ‘new firm,’ technology is a component of what we sell. It becomes part of the product.”

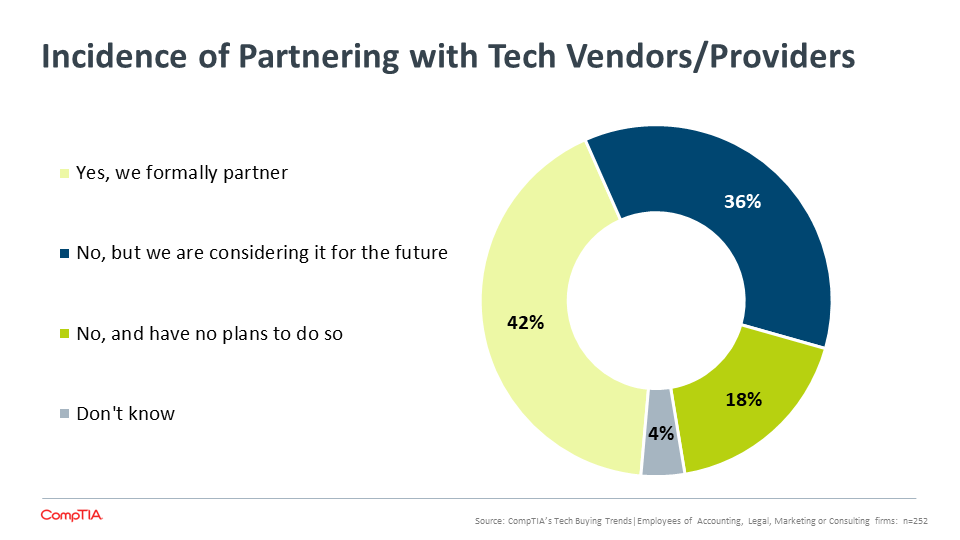

CompTIA’s study, which is confined to professional services firms with between 1-249 employees, found that 52% of are offering some technology services to their customers. Three in 10 are not doing so, but considering it, while 17% have no plans. Among respondents with an IT-related job role, 65% say they are actively offering some kind of tech services to customers. Given their role as the tech mavens at their respective firms, this finding is not all that surprising. It’s likely that they interface directly with a customer on a tech-related aspect of service, if needed.

Cloud computing adoption is leading many professional services firms to dive deeper into technology both internally and in their interactions with customers. Rather than hew to the traditional packaged software they have typically used to prepare a client’s taxes, for example, many CPA firms are turning to cloud-based applications that allow for greater interactivity with customers. Among law firms, technology consulting services are increasingly popular. Consider the work that many legal firms are offering today in the areas of compliance audits, which are critical for many industries such as financial and healthcare sectors. When it comes to marketing firms expansion into technology-as-business, they are heavily investing in services that revolve around Web site development, social media consulting and execution, and e-commerce.

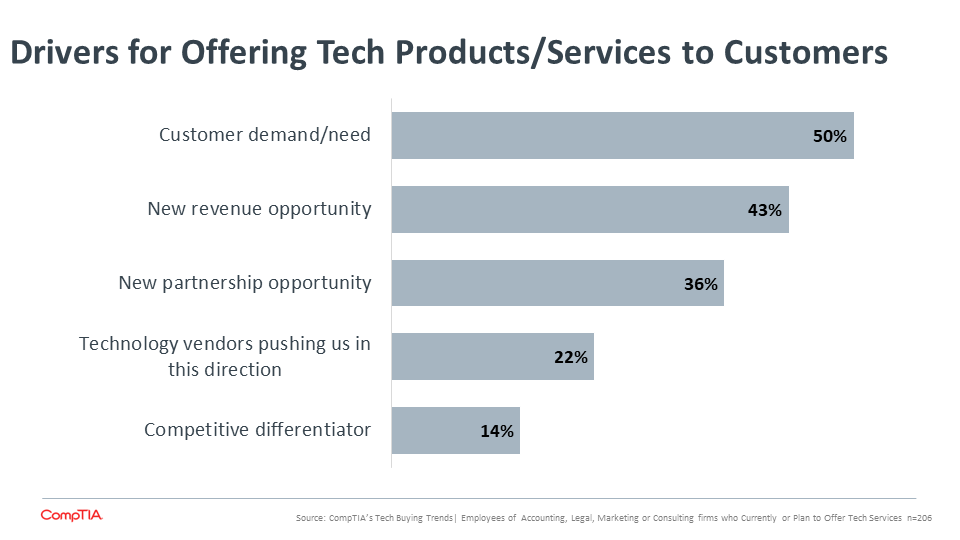

In the above examples, it’s clear that the customer plays a central role in a professional services firm’s decision to offer technology services, whether that is a specific product sale or, more likely, consulting and development work. Half of respondents cited customer demand as the main driver behind their tech work, which may reflect a desire by today’s customer to attain as many services as they can from a single provider. Other drivers include a desire for new revenue (43%) and for new partnerships (36%), presumably with tech firms. Notably, just 14% cited competitive differentiation as a driver, which could mean that offering tech products and services is no longer considered unique in this sector, but rather table stakes.

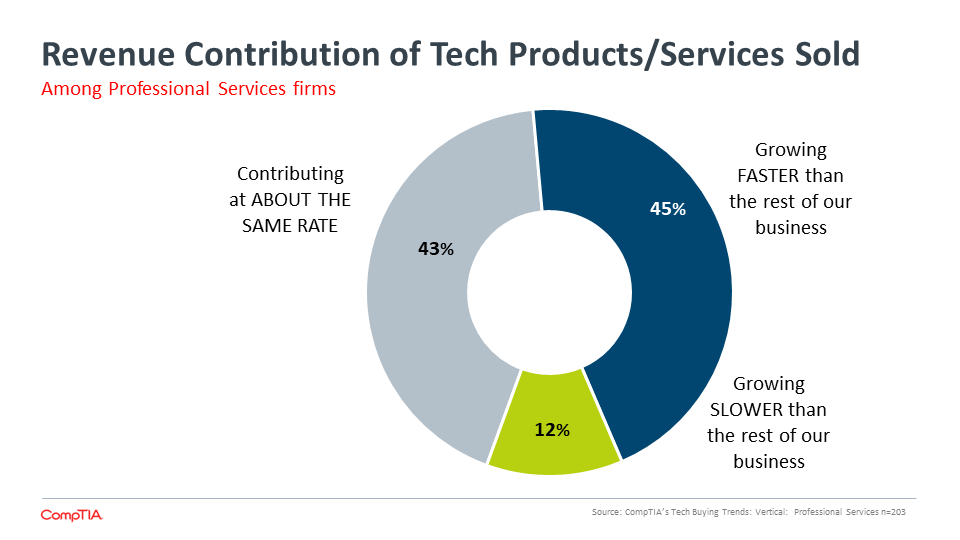

Professional Services & Tech Growth

For those professional services organizations that have taken the plunge, incorporating technology services as a complementary piece of their core business portfolio is paying off. It’s certainly a growth area. Nearly half of respondents (45%) said revenue from tech-related activities and services is growing faster than the rest of the business, while another 43% said the pace comparatively is about the same.

Now, it should be noted that the percentage of revenue that tech sales comprise of total sales for an accountancy or law firm is likely to be much lower than that coming from core business streams. But the fast-paced rate is nonetheless notable, demonstrating the validity of this trend. Customers are pushing their local CPAs, attorneys, and marketers to be up on the latest technology, while also looking to the for guidance about how they can best use technology to further their own businesses. What might start as a recommendation for a particular cloud-based tax or financial application could extend to the accountant assisting with the integration of that application with other tools and software within their customer’s environment.

Now, for reality. Being able to deliver on technical services that run outside such core competencies as filing court briefs or preparing complex tax returns is obviously not something done overnight – nor inexpensively. This can be especially tricky from a resources perspective for professional services firms at the SMB size, which this study is focused on. To be sure, many smaller professional services organizations gain confidence with technology as they use it. Over time, a level of technical expertise with the tools of the trade develop within these organizations and especially among specific members of staff. But to turn these skills into a business practice offered to customers, requires much more formality, process and accountability. One place to begin: training. Four in 10 respondents said adding a tech practice to their existing business compelled them to retrain existing staff to handle these new areas. A third decided to hire new employees dedicated to tech-related services. It’s most likely that many firms undertook a combination of both retraining and new hiring to meet demand. Another third sought the expertise of a third party to help the company reorient around a tech focus.

Third parties play an important role in this story too. Often, deciding to offer or recommend tech products and/or services to your clients entails working with a tech vendor of hardware, software or cloud-based solutions. Four in 10 respondents have formalized such partnerships in the last year, while 36% have not yet joined forces, but are considering doing so. By aligning with a vendor, professional services firms gain access to some of the benefits and resources that vendor has in its partner program, which help the sales and marketing process, among other things. But for SMBs, there can be cost of doing business that is prohibitive, as well as requirements in terms of sales quotas etc. that are not reasonable given the scale of tech-related business the particular CPA or law firm is even doing.

Research Methodology

This quantitative study consisted of an online survey fielded to small and medium business executives and professionals during November 2018. A total of 650 small and medium businesses based in the United States participated in the survey, yielding an overall margin of sampling error proxy at 95% confidence of +/- 3.8 percentage points. Sampling error is larger for subgroups of the data.

As with any survey, sampling error is only one source of possible error. While non-sampling error cannot be accurately calculated, precautionary steps were taken in all phases of the survey design, collection and processing of the data to minimize its influence.

CompTIA is responsible for all content and analysis. Any questions regarding the study should be directed to CompTIA Research and Market Intelligence staff at [email protected].

CompTIA is a member of the market research industry’s Insights Association and adheres to its internationally respected Code of Standards & Ethics.

Appendix

Read more about The Business of Technology.

.png?sfvrsn=6e8be05f_2)

.png?sfvrsn=bf2a97ea_2)

.png?sfvrsn=2af5c85b_2)

.png?sfvrsn=deee09a5_2)

.png?sfvrsn=86fb68fa_2)

Download Full PDF

Download Full PDF