Conceptually, the smart cities trend can be described as the application of technology to solve problems within cities and communities. Most citizens, businesses, and local government leadership can readily cite visible problems, such as traffic congestion or parking headaches, that could benefit from technology. While these types of use cases are a good starting point for the smart cities discussion, there is much more to the story, especially as it relates to behind-the-scenes innovations. The breadth of possibilities, and the accompanying complexities and unknowns, present as many questions as answers at this point. This latest research – based on opinions of citizens and government, provides further insight into how smart cities and communities are developing and what to expect going forward.

Key Points

Elevating the understanding of smart city concepts will take time; ‘bridge technologies' can help

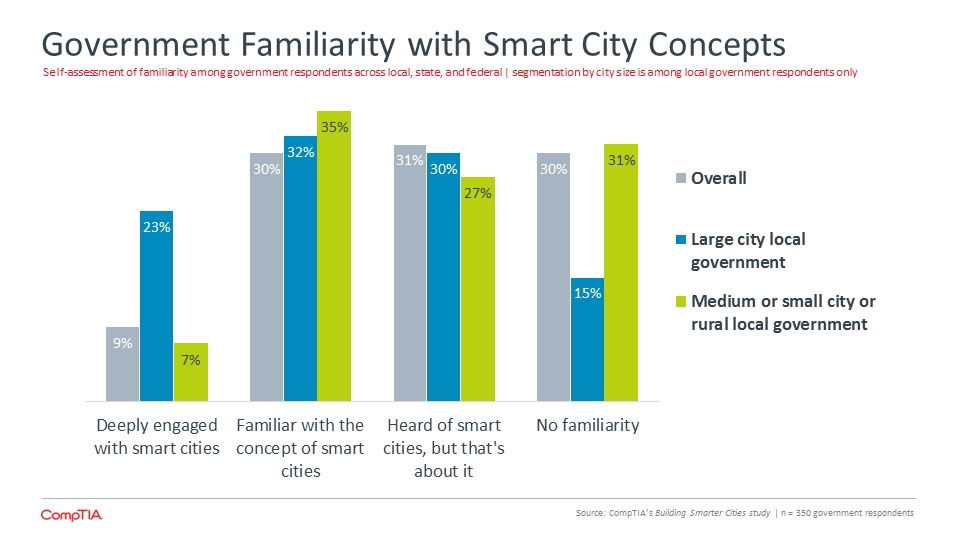

Despite the growing number of smart city initiatives underway, the trend still has a ways to go before it fully resonates with stakeholders. CompTIA research indicates familiarity among citizens, especially those in smaller towns and rural areas, is low. Among segments of government, familiarity is only slightly better. The emergence of a wide-range of smart technologies for home or business use is starting to provide exposure to virtual assistants, artificial intelligence, predictive analytics, robotics, and more.

Making the leap from digital to smart requires advances on many fronts

Most municipalities are on the digital continuum, meaning some level of e-government services are provided to citizens or technology used in an operational capacity. To make the leap from digital to smart, however, requires more than deploying a new mobile app and a few sensors. Rather, it typically requires a re-thinking of everything from IT architecture and broadband infrastructure, to workflows, user experience (UX), staff training and more. Smart cities must be built on smart foundations.

Data is critical to smart city success...and one of the most challenging components to get right

There are many moving parts to the data component of smart city pursuits. Given the countless examples of private sector firms wrestling with big data challenges after years of effort, it must be assumed local governments, many of which lack deep data expertise, will face many data-related hurdles.

Ensuring smart cities are cyber-safe will require resources and a commitment to shared responsibility

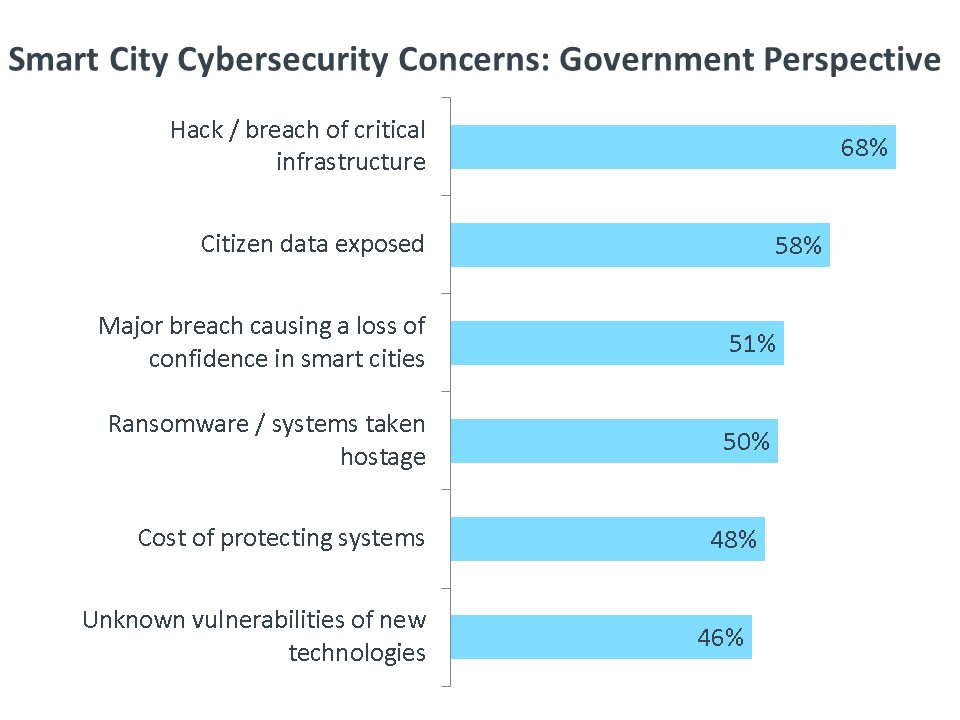

Across the board, businesses, government leadership, and citizens voice concern over the ever-expanding scope and severity of cybersecurity threats. As smart city initiatives move into the realm of critical infrastructure and tapping into new streams of sensitive data, the consequences of inadequate defenses become even more dire. To mitigate the risk of worse-case-scenarios, a concerted effort will be required to implement strong cybersecurity fundamentals – including cyber training, coupled with the agility required to address emerging threats.

MARKET OVERVIEW

Smart city discussions raise the fundamental question: what defines a smart city? While common themes have emerged over the years that provide some parameters, a consensus definition remains elusive. In part, this reflects the diversity of cities and towns; each unique in some way. Additionally, a diverse set of stakeholders, including technologists, city planners, municipal staff, economic developers, and more, bring perspectives and expertize that shape their views of smart cities. Lastly, a constantly evolving technology landscape brings new tools, data streams, standards and vendors to the mix. Acknowledging these factors helps to set realistic expectations for market sizing and growth projections.

Global smart cities expenditures are predicted to reach the $1.2 - $1.7 trillion range over the next few years, according to forecasts from research consultancies Market and Markets, McKinsey & Company, and Frost & Sullivan. The large variance between the upper and lower bounds are a function of differing opinions on the speed of adoption, economic fundamentals, or the types of expenditures included in the definition of smart cities.

The last point is especially thorny. For many smart city investments, it’s not always possible to break out the ‘new’ technology spending from the baseline spending. For example, a smart street light may have a few extra dollars worth of sensors and and an additional sum for computing, data analytics and the functionality that provides the smarts. Should the full cost of the street light be counted as a smart city expenditure or should it only be some factor above the baseline cost for street lights?

Another useful reference point for putting smart city expenditures into context is the budget allocation for IT at the state and local level. A number of research consultancies – Gartner, Forrester, and the Center for Digital Government, estimate state and local government IT spending in the U.S. of $75 - $112 billion. While some states and municipalities may publish data on IT budgets, not all do, which accounts for the variance in the estimates from the research consultancies.

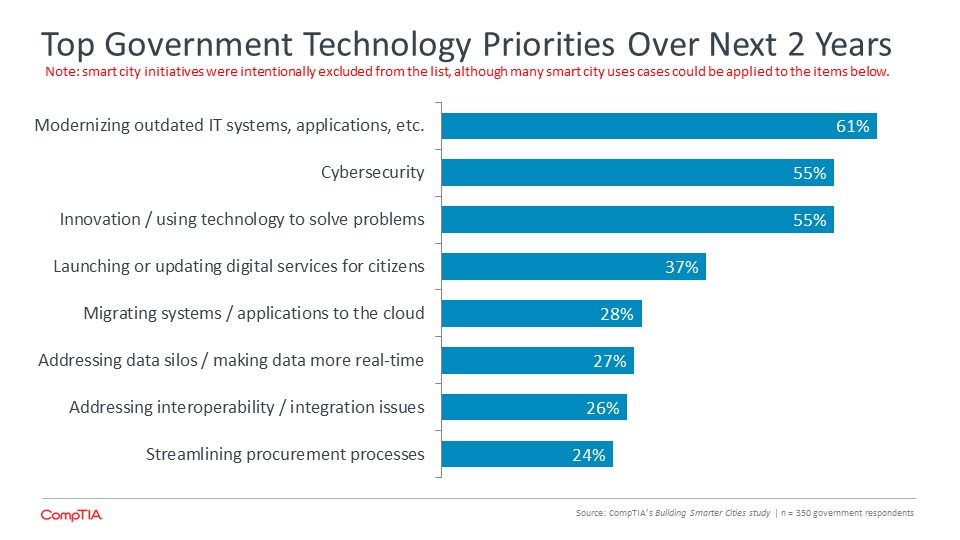

After years of shrinking or flat IT budgets following the Great Recession, many states and locales are finally back in a position to increase spending in high priority areas. When asked about overall priorities, increasing technology utilization ranked as a top prerogative among government officials and personnel. Other priories, such as improving operational efficiency, addressing infrastructure needs or public safety concerns, will inevitably have some intersection with technology. The big question for smart cities, of course, is how much intersection?

Delving deeper into government priorities specific to technology, three focus areas stand apart. Governments report a strong desire to modernize outdated IT systems, devices, and applications, improve cybersecurity defenses, and accelerate innovation to solve problems.

For larger cities (250,000+ residents), innovation and applying technology in new ways to solve problems ranked as their top technology priority, slightly edging out modernization efforts. Medium-size and smaller cities and towns had nearly identical priorities. Modernizing outdated IT systems, devices and applications may be ranked slightly higher than innovation, but the data is not conclusive.

While not specifically introduced as an option at this point in the research, it can be assumed that smart city initiatives could fall into a number of the categories in the above chart: certainly innovation, but probably also IT modernization and providing new digital services for citizens.

Cities and Communities in Review

- According to the U.S. Census Bureau, in 2016 there were 761 U.S. cities with populations of 50,000 or more. Cumulatively, the populations of these cities account for 39% of all U.S. residents, or approximately 125 million persons.

- In 2016, there were an estimated 2,281 small cities and towns with populations between 10,000 and 50,000. In the the under 10,000 population category, there were an estimated 16,470 small towns and rural communities.

- The trend in the U.S. and many parts of the world has been towards greater urbanization. This raises the issue of increasing urban-rural digital divides.

LAYING THE GROUNDWORK FOR SMART CITIES

Resource allocation, and the accompanying planning required for execution, is a core function of government. Regardless of scale, smart city initiatives require planning – often extensive planning. On the technology axis, assessments of technology and communications infrastructure is the logical first step. Evaluations of software, hardware, and data systems follow suit. As these elements come together, in some ways, the city itself could be thought of as the platform.

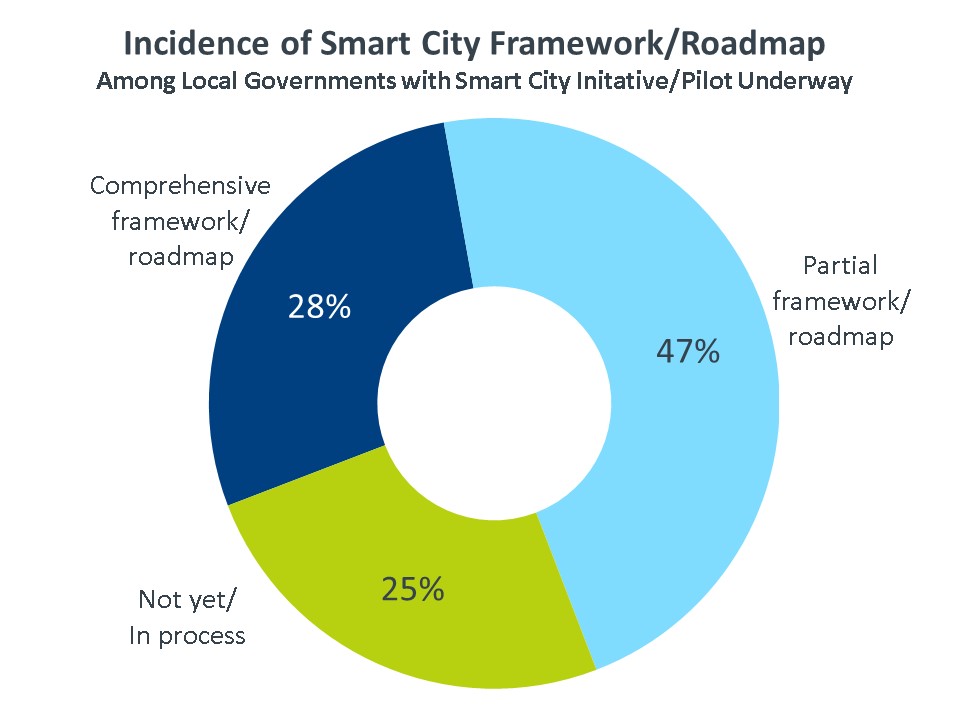

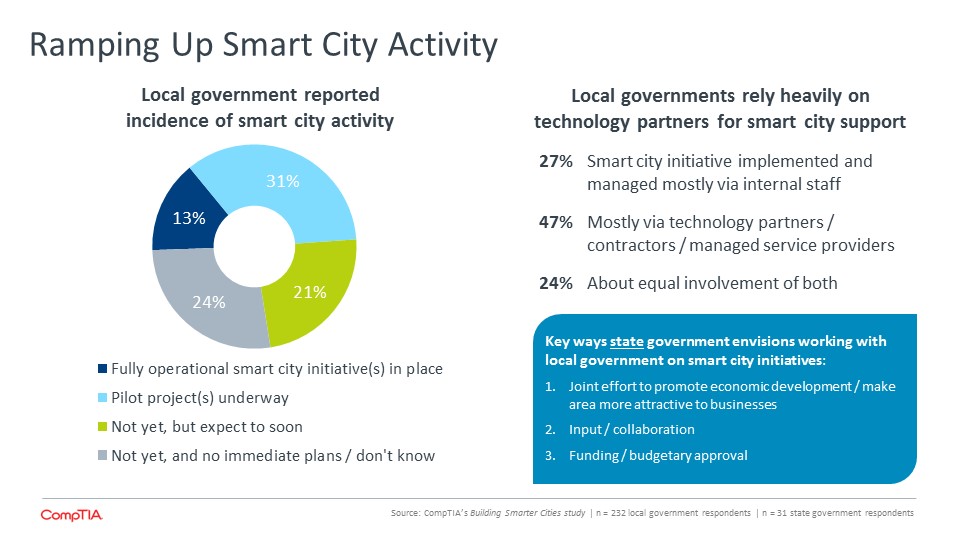

Among the 13% of municipalities that report having a fully operational smart cities initiative deployed, and the 31% that have some type of pilot underway, the greatest number report struggling with building the business case. As with many early-stage technologies, the lack of hard data and the challenge of “not knowing what you don’t know” often leave business plans short of stakeholder needs (at least in the short-term).

Rank order of challenges in starting smart city projects- Building the business case for the range of stakeholders

- Finding local city and/or business leaders to champion it

- Seed funding to get pilots off the ground

- Decisions regarding technology platforms, vendors, etc.

- Idea stage / deciding on which initiative to pursue

Among those with a comprehensive or partial smart cities framework or roadmap in place, most report turning to one of three primary sources for guidance: 1). State or local government agencies, 2). Technology vendors, solution providers or consultants, or 3). Internal staff. Additionally, smaller percentages cite assistance from a Federal government agency, such as NIST, or from an industry group, such as the Smart Cities Council’s readiness guide. For technology vendors and solution providers, this serves as a reminder to invest adequate time in understanding people and process dynamics, and their relationship to end goals, before jumping into technology recommendations. This is one way to think about the difference between deploying technology and deploying technology intelligently.

Smart ‘home’ technologies help teach citizens about the possibilities of smart ‘city’ technologies. Consider:

- 6 in 10 consumers are familiar with the concept of smart ‘home’ technologies. Awareness rates are highest for virtual assistants (e.g. Amazon Alexa), home robotics (e.g. Roomba vacuum), and smart thermostats (e.g. Nest).

- Among households that report owning some type of smart home technology, familiarity with smart cities concepts is 5 times higher than households that do not own any smart homes technologies (52% vs. 10%).

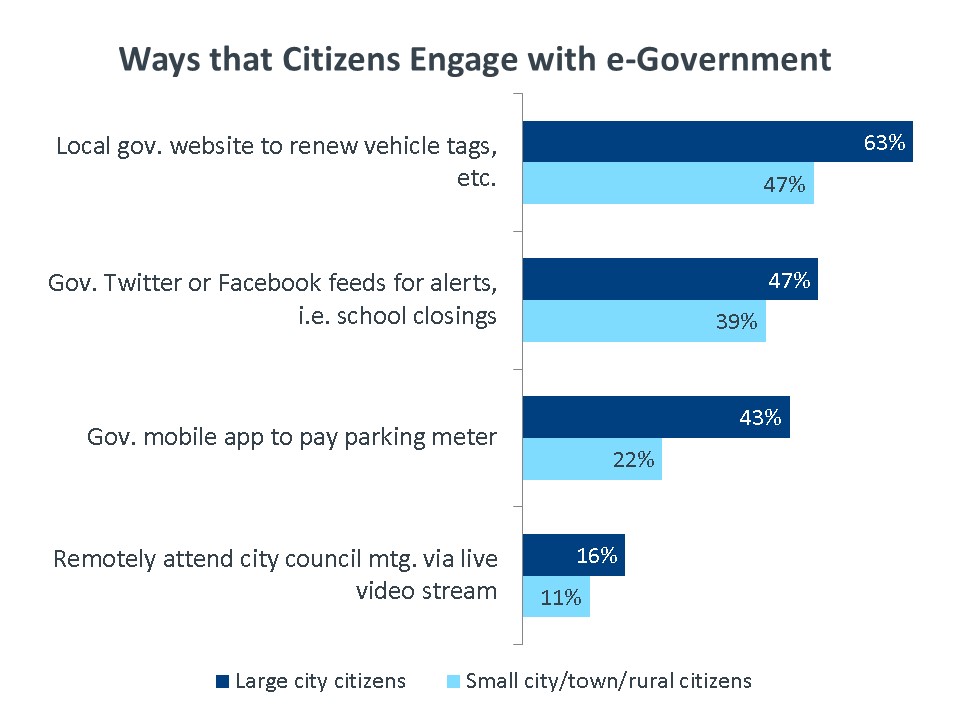

Relatedly, citizens increasingly engage with e-government services, ranging from websites and mobile apps to social media, to perform tasks or access information. These actions are important stepping stones, helping to prepare citizens to engage with more sophisticated smart city technologies.

USE CASES PROVIDE INSIGHT INTO THE FACETS OF SMART CITIES THAT ARE OF MOST INTEREST

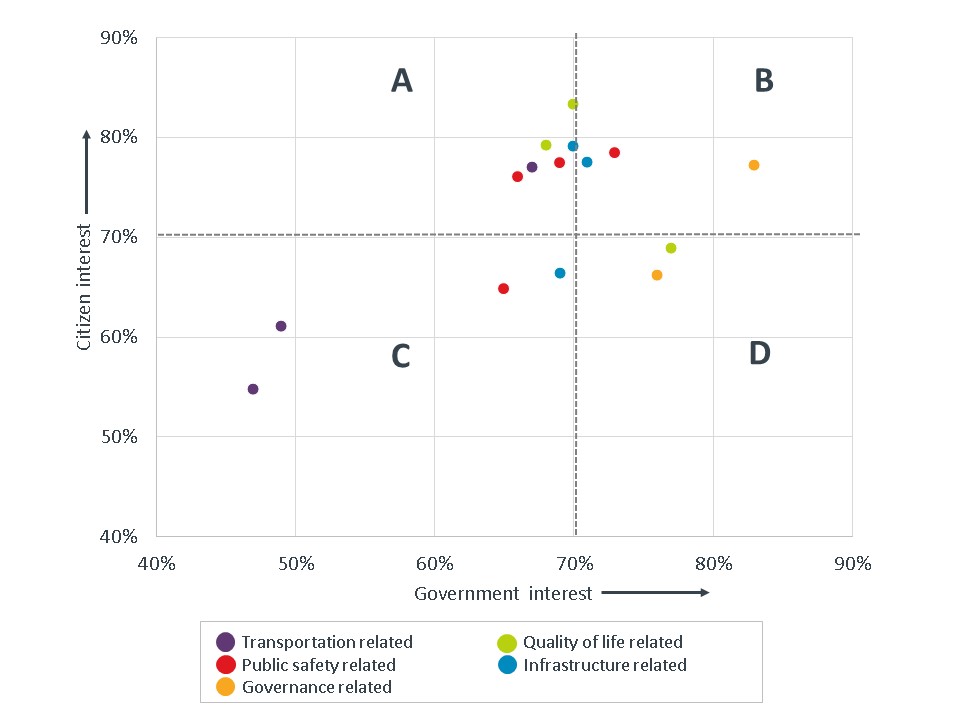

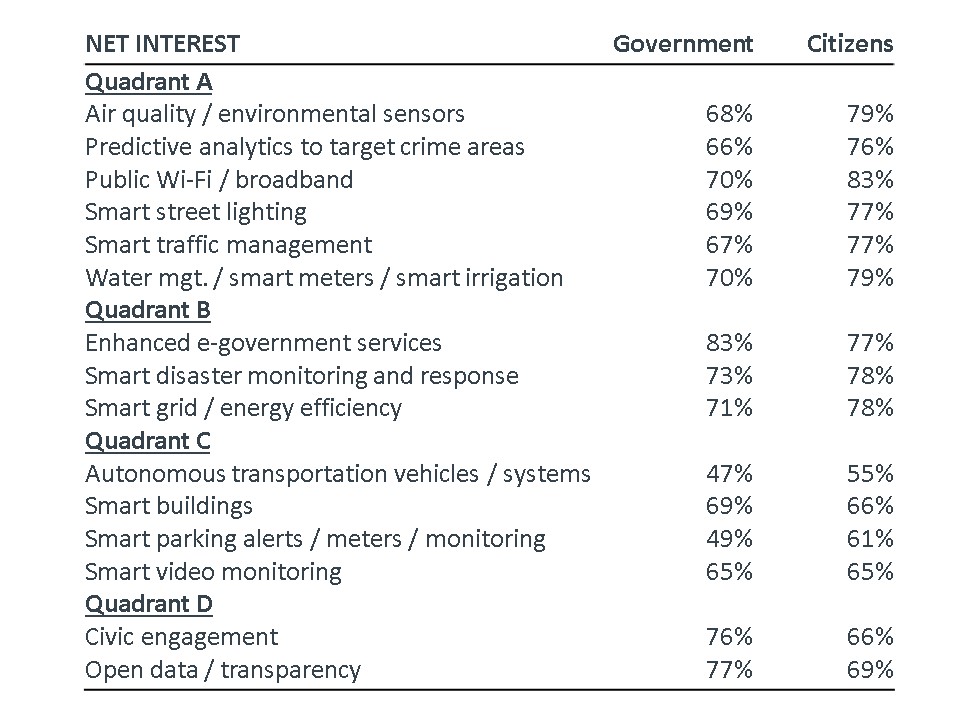

Abstract smart city concepts begin to come into focus with the introduction of use cases. While not meant to be an exhaustive list, the examples in the table to the right provide a baseline for understanding citizen and government perceptions.

When presented at the category level, citizens overwhelming rank public safety as the top smart cities priority, followed by quality of life. For some respondents, it may reflect a legitimate concern over crime. For others, it may be more about gravitating towards the area of smart cities that may be easiest to understand and easiest to envision tangible benefits.

When smart city use cases are presented individually, citizen priorities become less clear cut and far more expansive. Respondents place more emphasis on quality of life use cases, as well as interest in the infrastructure and transportation-related categories.

Key differences become apparent when evaluating the data at the city-size level. For example, citizens in very large cities, where traffic and parking can be major headaches, place a higher priority on smart transportation initiatives relative to citizens in smaller towns or rural areas.

Women and men had similar levels of interest in most areas. Differences did emerge in the areas of smart city applications related to combatting crime and those related to enhanced e-government services, where women expressed slightly higher levels of interest.

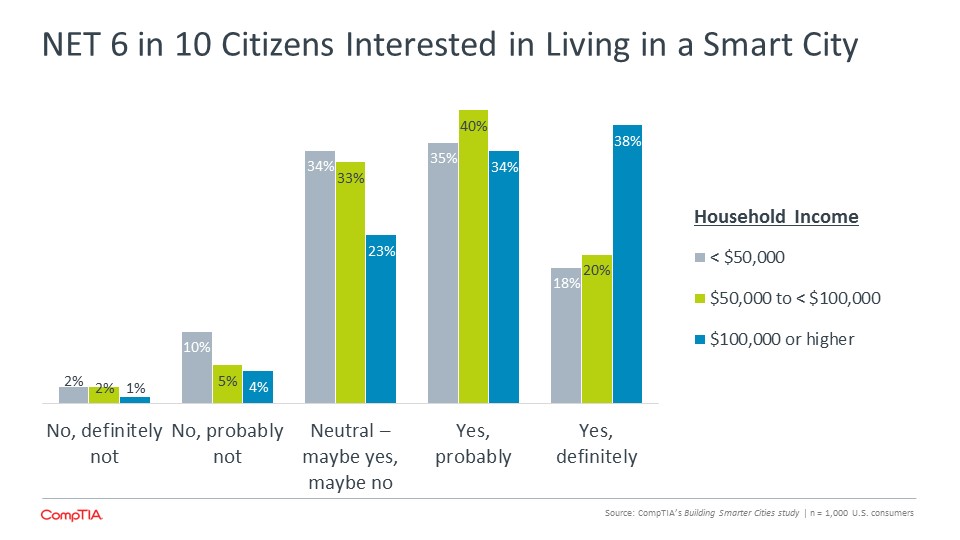

On average, citizens in the 30-39 age segment reported the highest levels of interest in smart city uses cases. Similarly, those with household incomes of $100,000+ reported higher levels of interest, on average, in smart cities relative to households at lower income levels.

Mirroring the opinions of citizens from large cities, government officials and personnel of large cities rate transportation-related smart city initiatives, such as traffic management systems, a top priority. This corroborates the degree to which traffic and transportation chokeholds are viewed as serious problems with far-reaching consequences. An estimate from the research consultancy INRIX pegs the direct and indirect cost of traffic congestion in the U.S. at $124 billion annually.

Other top priorities for large cities from the perspective of government officials and personnel include enhanced e-government services, and predictive analytics for targeting high crime areas.

Medium-size cities and smaller cities or towns also rate enhanced e-government services a top priority. The next two highest priorities include smart water management systems and smart grid and energy management-related pursuits. Regional differences come into play as well for some uses.

Note: the surveys included descriptions of each smart city use case to provide respondents enough background to rate their level of interest. Some use cases may overlap into multiple categories; for the purposes of reporting, they were limited to a single category.

ASSESSING SMART CITY ADOPTION DRIVERS

To date, smart city pilots have largely been driven by city leadership or by technology providers or institutions such as universities. To move beyond the pilot phase, which will entail larger investments and disruption on some level, buy-in will be required from stakeholders.

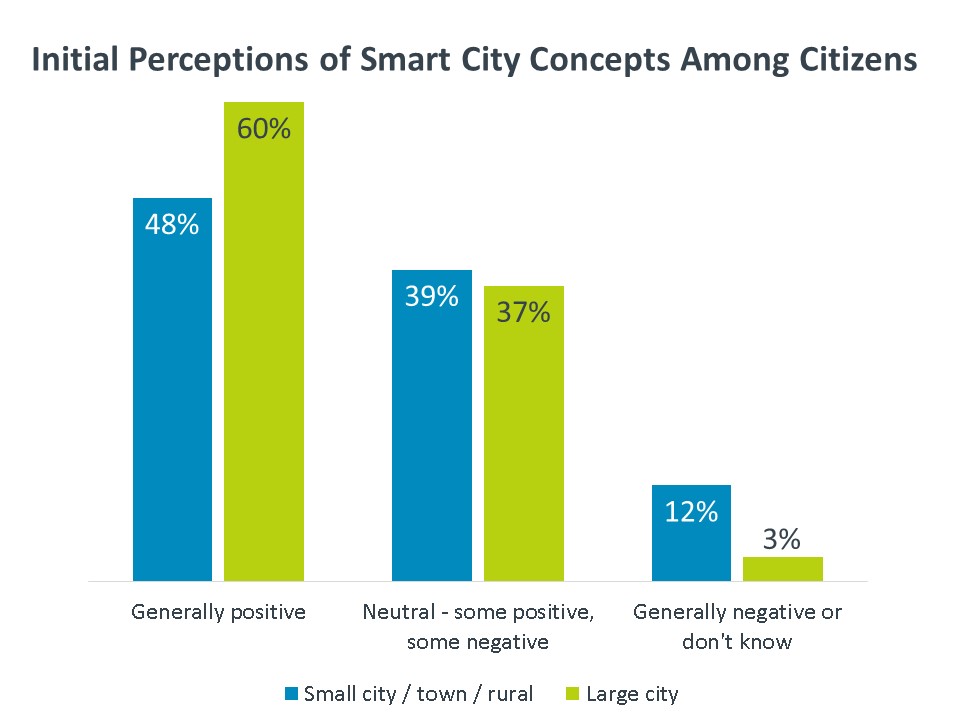

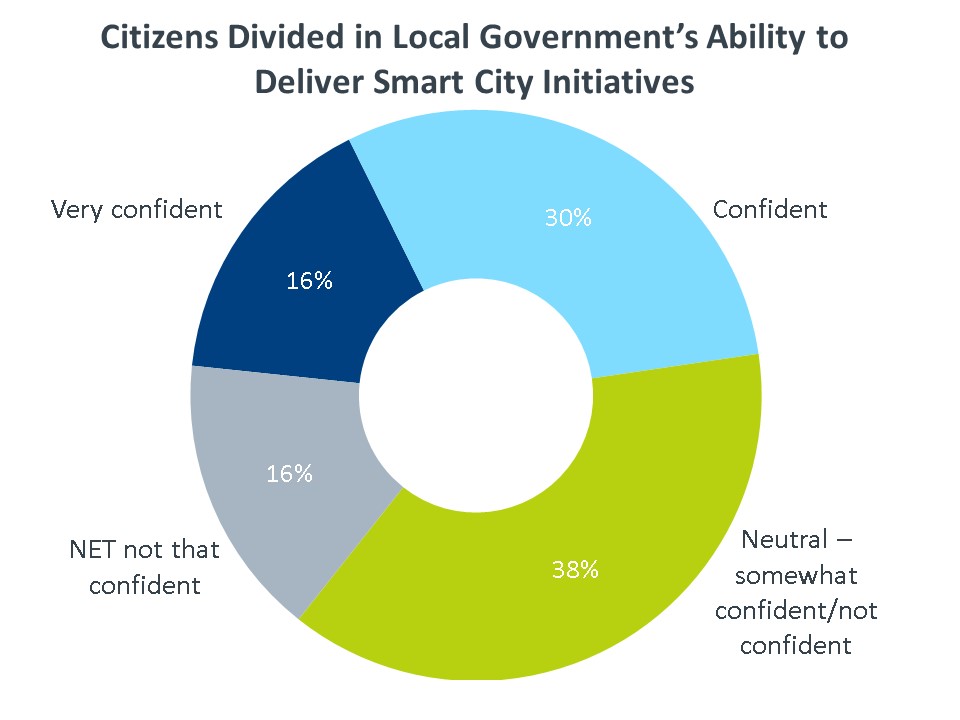

Putting aside budget implications and tradeoffs for a moment, among citizens with some degree of familiarity with smart city concepts, a slight majority have an initial positive impression. This early goodwill can be helpful as discussions progress. While positive sentiment is not necessarily an accelerator on its own, the reverse is almost certainly true: negative early views may prolong or derail smart city developments.

6 in 10 Share of citizens indicating they would definitely or probably support a ballot initiative involving smart city initiatives in their community.

Rounding out the other vital stakeholder group is the business community. As taxpayers, businesses have a vested interest in budget allocations that may involve smart city investments. Additionally, businesses today increasingly compete within and outside of their local market for customers, labor talent, capital and partner ecosystems. When asked about the possible value of smart city initiatives to the business community, the top cited benefit revolved around raising the profile of the city and the businesses located there. Reading between the lines, this likely encompasses the desire to see smart city initiatives help a city attract more investment and be viewed as a desirable location for business activity. The second key benefit focused on attracting skilled workers and retaining them, such as through smart city initiatives that improve livability; thereby contributing to greater job satisfaction and productivity.

Government ranking of key benefits of smart cities- Sustainability / optimizing use of resources

- E-government and related digital services for citizens

- New / better streams of data to improve decision-making

- Better visibility / monitoring of infrastructure and assets

- Opportunity to attract tech-savvy workers or businesses

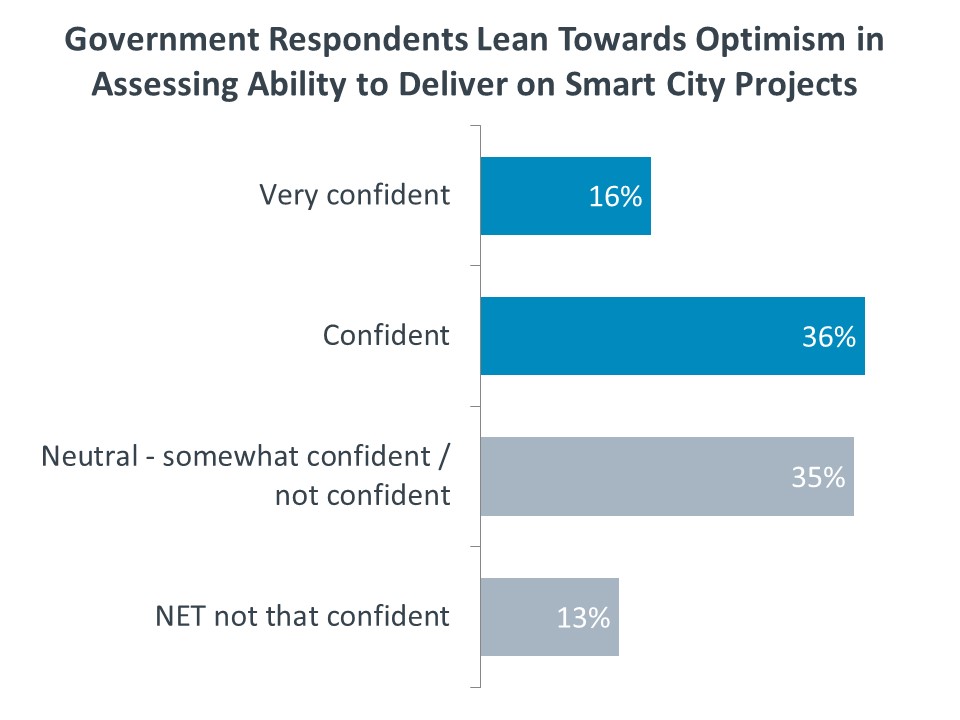

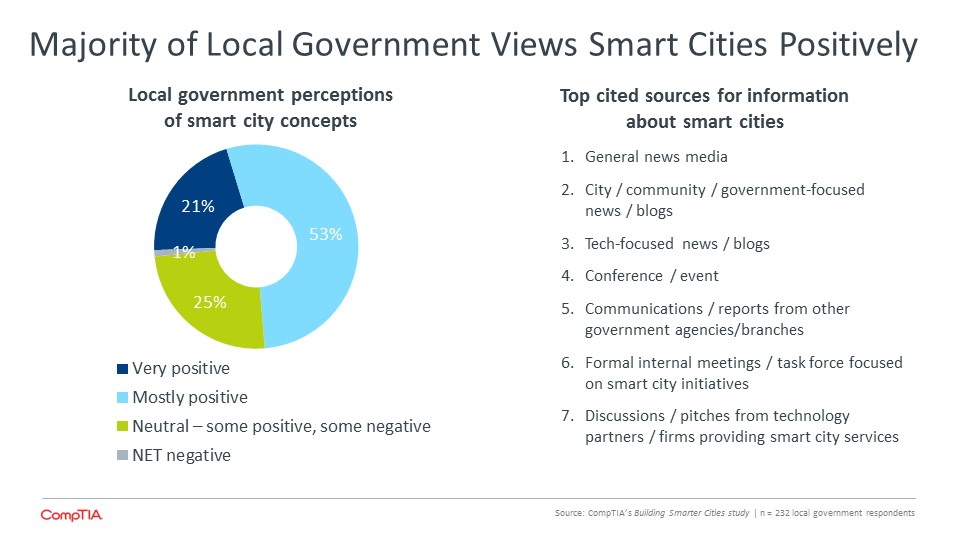

As noted previously, the government officials and personnel at the federal, state and local levels participating in this CompTIA research study voiced positive sentiment for smart city concepts – 21% very positive, plus 53% mostly positive.

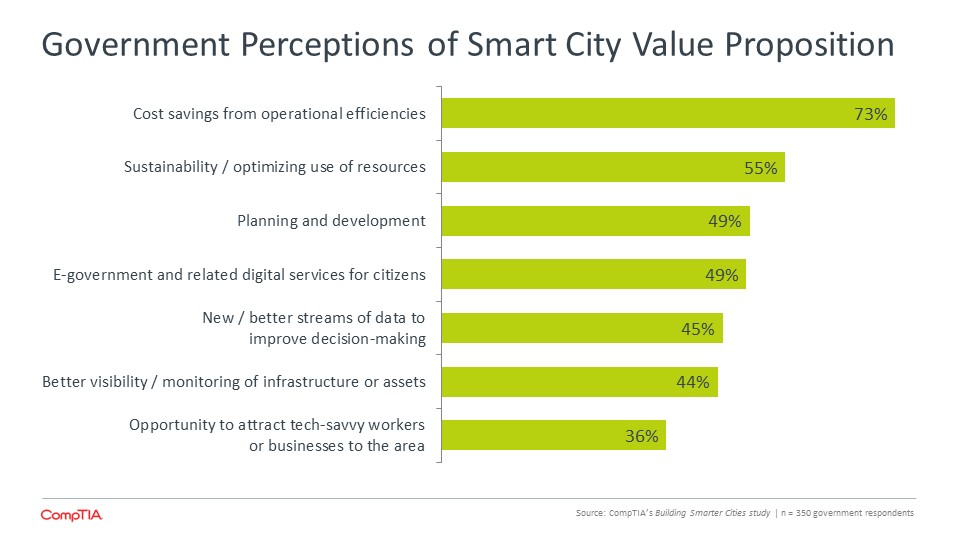

Consistent with CompTIA research conducted in 2016, government officials and personnel rate cost savings from operational efficiencies as a key selling point of smart city initiatives. Some cities or communities may have a shrinking tax base, which means do-more-with-less is modus operandi. Others may be in the opposite position whereby population growth is straining city resources and efficiency gains are desperately needed. Setting unrealistically high expectations is a pitfall with many emerging technologies; a risk that is especially great with smart city initiatives. Complex city or community problems will not be solved by technology alone.

Related to cost savings is the desire to enhance sustainability efforts. This may entail implementing smart resource management technologies to ensure scare water or energy resources are used as efficiently as possible.

Operational and resource efficiency is undoubtedly important, but in many cases, occur behind-the-scenes. Citizens may see the outcomes in the form of a city budget surplus or a lower carbon footprint, for example, but these types of smart city benefits may be perceived as less tangible. The data suggests government officials and personnel are well aware of this, yielding strong interest in smart city initiatives that deliver direct benefits to citizens and the business community in the form of enhanced e-government services. In the grand scheme of city operations, it may appear to be a relatively small thing to improve the user experience for renewing vehicle tags or access public transportation information, for example, but for many citizens, these types of engagements shape perceptions of what the future holds with smart cities.

WORKING THROUGH ADOPTION INHIBITORS

It’s not hard to form a mental picture of the likely hurdles smart city initiatives will face. The challenge comes in understanding how to prioritize resources to tackle these hurdles and the degree to which perceived challenges align with reality.

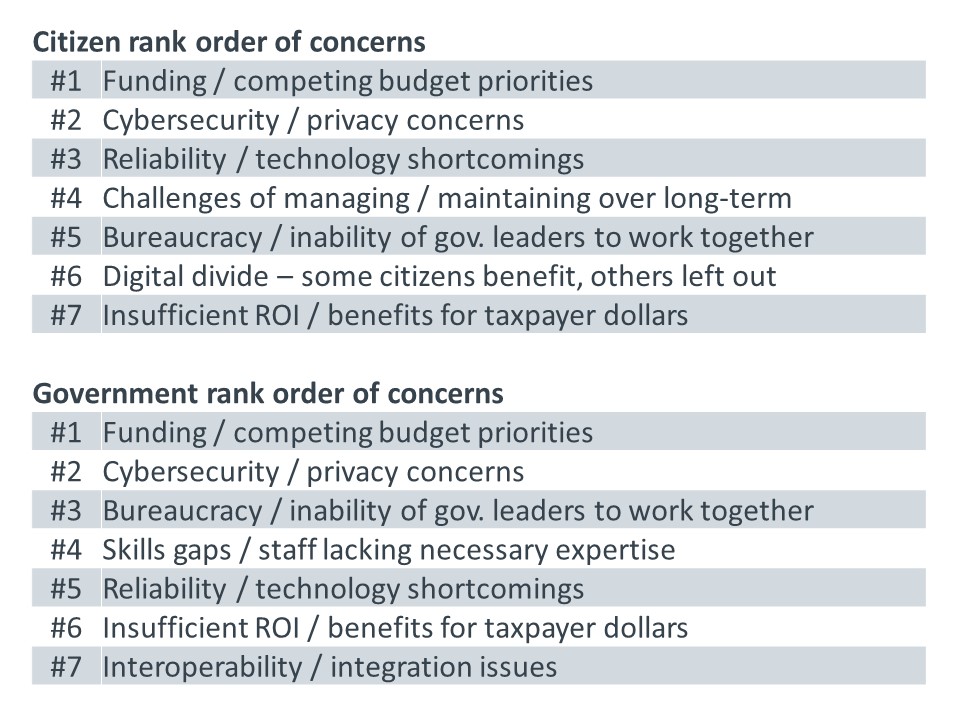

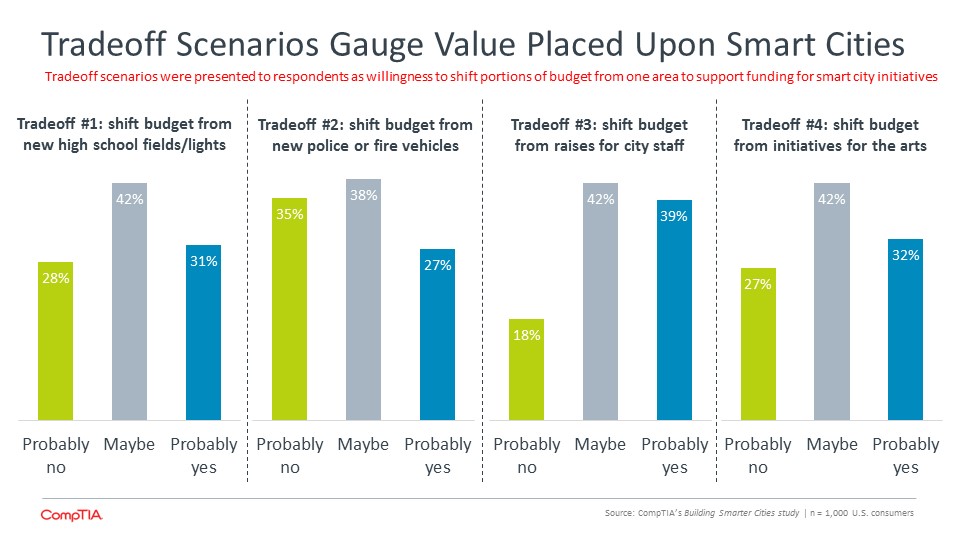

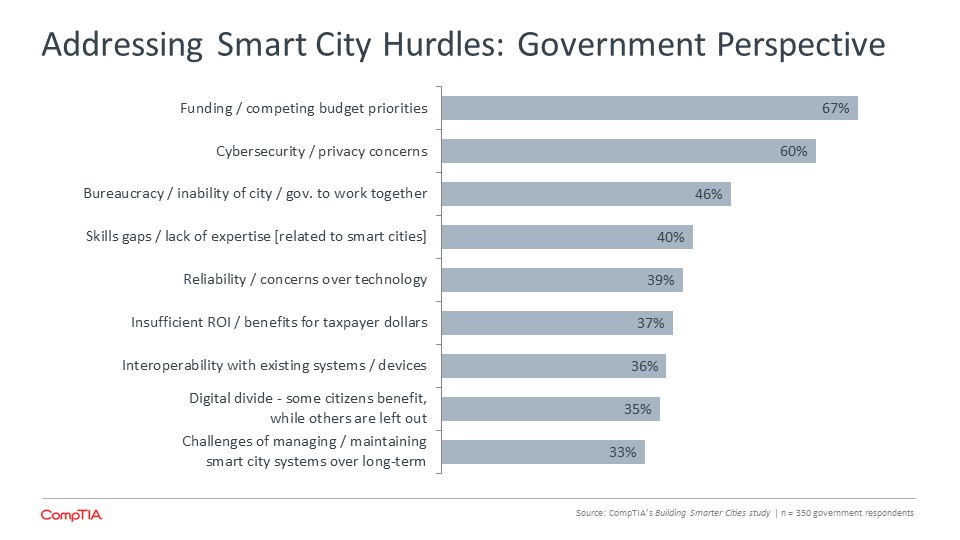

On the first point, the research indicates citizens and government are in agreement on the most pressing concerns related to the rollout of smart city initiatives. Of course, all the concerns listed in the table below are important in some way. Moreover, there is some variance in the data so the rankings are directional in nature. With that being said, these perceptions are useful in providing guidance to smart city proponents, who will need to be prepared to address concerns throughout the smart city implementation lifecycle.

As expected, concern over funding and competing budget priorities is front and center for citizens and government respondents. According to the U.S. Census Bureau Survey of State and Local Government Finance, state and local governments devote slightly more than two-thirds of their budgets, on average, to education, social assistance, healthcare, police and corrections. All remaining expenditures, including infrastructure, transportation, parks and recreation, and government administration are funded from the remaining slice of the pie. This underscores the concern expressed by citizens and government – most municipalities have little wiggle room within budgets to shift funds from critical services to investments in new areas, whether a smart city initiative or a new community center.

On the second point, there are a couple of possible red flags in the rankings. Prior CompTIA research detailing the steps of digital business transformation confirm the inherent challenges involved in integrating new technologies with legacy technologies. While virtualization, APIs and cloud platform advances (PaaS) are helping to ease integration challenges, interoperability is still a common issue. As such, government respondents may be underestimating this aspect of smart city implementations. This should also serve as a reminder to technology vendors and solution providers to not gloss over the time and resources required for integration.

The other concerns that may be slightly underweighted include ROI and digital divide. Without adequate attention or metrics, negative perceptions could form, which could be more difficult to overcome than the technical challenges.

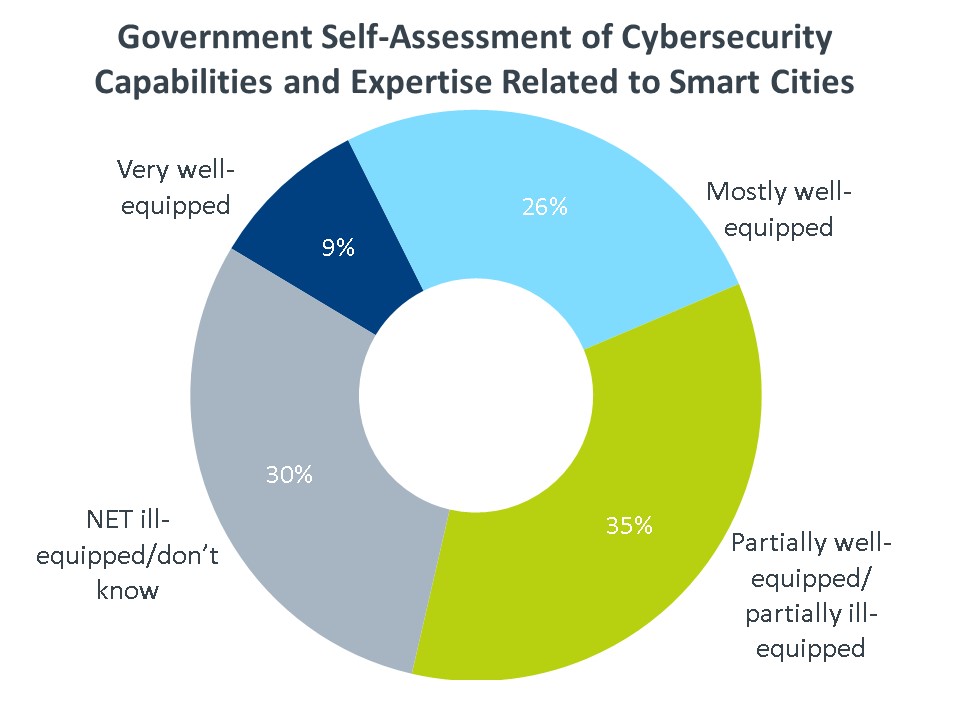

MAKING CYBERSECURITY A PRIORITY IS A GOOD START; HOWEVER, IT MUST TRANSLATE TO ACTION

Security will get worse before it gets better. This trend from CompTIA’s 2017 IT Industry Outlook aptly captures the state of cybersecurity today. While there have been improvements to security defenses and the ways organizations manage cyber threats through policies and employee training, the cybersecurity arms race continues to tilt in favor of the aggressors.

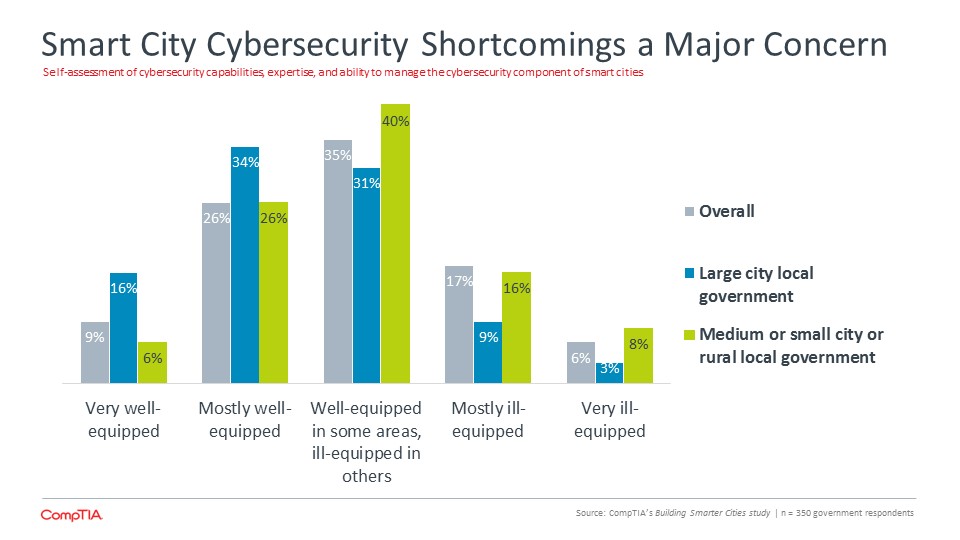

Somewhat reassuringly, government officials and personnel rank cybersecurity a top concern affecting smart city initiatives as they transition from the pilot stage to the full production stage. What this means when the time comes to devote resources to best-in-class technology, robust end-to-end processes, and on-going training for staff remains to be seen. As seen time and again, a misstep in just one area – a patch not updated in a timely manner, an employee that falls for a phishing email, or a sloppy partner with network access, can quickly compromise security defenses.

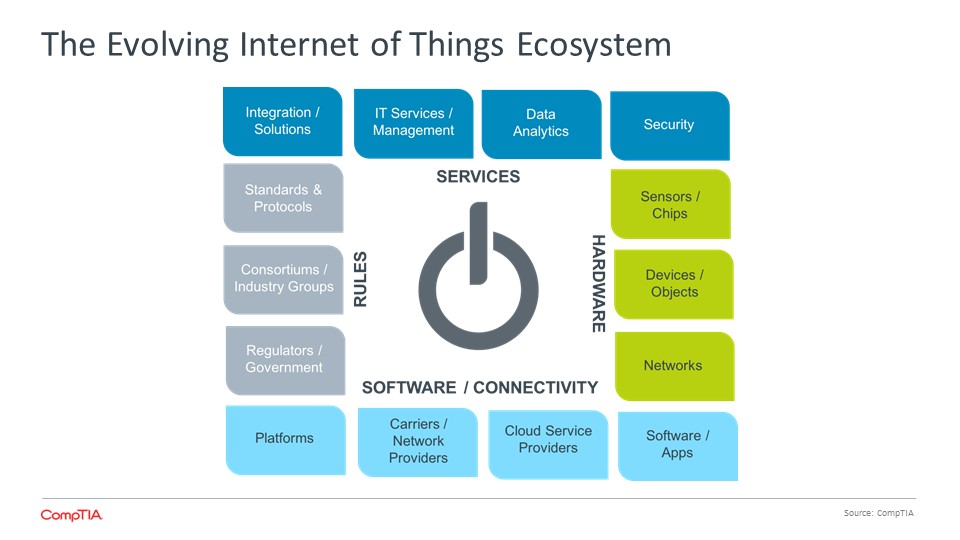

The stakes are already high – the massive breaches at Experian, Yahoo and OPM quickly come to mind, but the damage has been mostly financial, time, or lost confidence. The rapid growth of the internet of things (IoT), which expands connectivity through smart cities, autonomous vehicles, drones, and the like, drastically changes the equation. The consequences now potentially involve the physical world in the form of crashes, outages, or mass disruption. The widely publicized cyberattack of the Ukrainian electric grid in 2015, which left nearly a quarter-million people without power, is a stark reminder that this is no longer in the realm of the hypothetical.

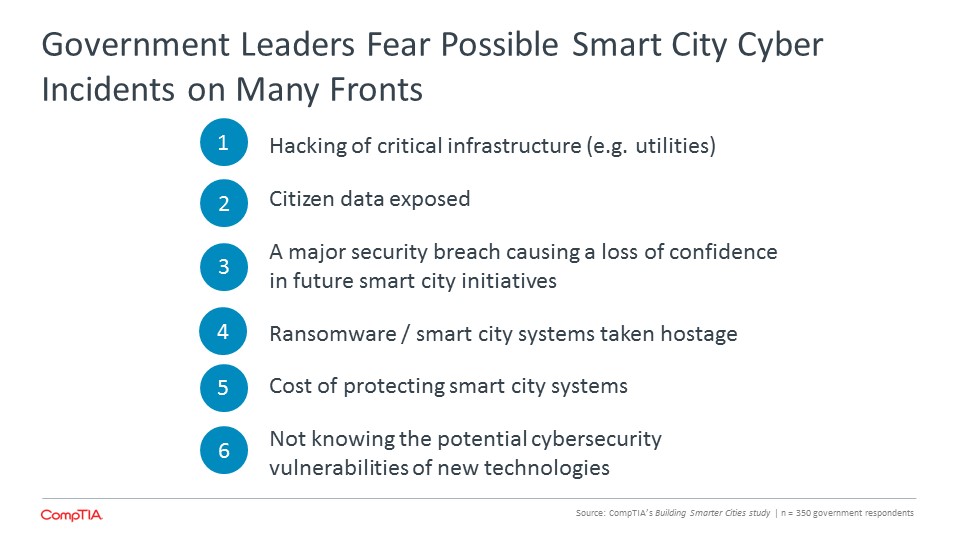

The research confirms this fear. Government respondents rate threats to critical infrastructure as their top smart cities cybersecurity concern. Similar to much of the data presented in this report, the rank order is more important than the nominal values.

- Don’t reinvent wheel – leverage existing planning resources. The U.S. National Institute of Science and Technology (NIST) has published two cybersecurity frameworks that every municipality embarking on a smart city initiative should be familiar with: 1). Framework for Improving Critical Infrastructure Cybersecurity, and the 2). Cybersecurity Workforce Framework. In addition to the obvious focus on security defenses, these frameworks cover the vitally important detection, identification, response, governance and cyber-physical components of planning.

- In anticipation of smart city rollouts, begin early with staff training and talent retention efforts. It’s well-established that every knowledge worker is a cybersecurity asset if properly trained, or a liability if not. For technical staff, government entities must find ways to attract and nurture them given their options in the private sector. Well thought out retention plans, including career pathway guidance, are proven tactics. See CompTIA’s Cybersecurity Hub for resources and CyberSeek for cyber-talent supply and demand analysis.

- Engage with technology partners strategically. Working with the government often elicits thoughts of slow-moving bureaucracy and cumbersome procurement procedures. Addressing these real or perceived issues can help optimize the relationship with technology providers, especially smaller managed services providers that can offer the type of personalized support often needed at the local level. While not specific to smart cities, CompTIA’s Buying Guide for IT Security provides guidance on the types of questions to be thinking about when evaluating technology partners.

- During budget discussions, work to shift the mindset of cybersecurity as a cost center to cybersecurity as an investment. It should be acknowledged that this is difficult to do, however, even modest efforts can pay dividends.

CHARTING A COURSE FORWARD

In late 2015, the Obama administration instituted a smart cities initiative to spur innovation and promote the creative use of technology and data to address local problems. One facet of this initiative entailed the launch of the Smart City Challenge, a U.S. Department of Transportation grant program. Columbus, OH won the inaugural award, beating out 77 other cities. In addition to the funding, the Smart City Challenge program sought to facilitate the sharing of best practices and lessons learned (summarized here: Smart City Challenge: Lessons for Building Cities of the Future).

Looking ahead, all signs point to continued momentum, optimism, and interest among stakeholders in expanding smart city deployments. However, there are no guarantees smart city technologies will progress from niche uses and experimentation to comprehensive utilization, yielding digital transformed cities and communities. These are the types of outstanding issues and questions, echoing some of the findings from the Smart City Challenge lessons learned, that government entities, citizens, and the private sector will need to work through in the years ahead:

Policy and regulatory

On the policy and regulatory front, the burst of innovation over the past few years has spurred much debate. The building blocks of smart city initiatives – internet of things (IoT), artificial intelligence, autonomous vehicles, drones, biometrics, the sharing economy and more – routinely push into regulatory gray areas. Consider just a few examples:

- What if an autonomous vehicle hits a pedestrian?

- What if artificial intelligence-based predictive analytics tools engage in discriminatory behavior?

- What if a city wants to sell the location data it collects from its citizens? Who owns the data? How is consent handled?

- What are the privacy ramifications of pervasive drone or facial recognition video monitoring?

- What are the consequences of a breach involving critical infrastructure when cybersecurity best practices were not followed?

Many of these questions are top of mind for government agencies, regulatory bodies, Congress, industry groups, and citizens. In some areas, new regulatory frameworks or legislation has been discussed. In others, such as Kansas City, which enacted a set of smart city data privacy principles, proactive efforts to get out in front of looming issues are underway. The issues are undoubtedly complex and the availability of easy answers are few and far between.

Data

Simply put, cities and communities will have to get better at managing and using data. Many municipalities have work to do to get their current data house in order before even thinking about smart city data streams. Beyond the inevitable challenges involving reducing data silos, municipalities will need to elevate the data skills of their workforce, both on the technical side and the business intelligence side.

Workforce

As discussed in several sections of this report, smart city success rests on the optimal blend of people, process and technology, working in concert to solve meaningful problems. According the U.S. Bureau of Labor Statistics, local government employs approximately 90,000 IT workers (note: this excludes IT workers employed in public education or hospitals). States employ about 81,000 IT workers. The next phase of smart cities growth will be contingent on expanding the depth and breadth of expertise among state and local IT staff, and as challenging as it may be to add headcount, expand the workforce. Moreover, as smart city initiatives bridge the physical and digital world, government staff at every level will need to be able to do the same.

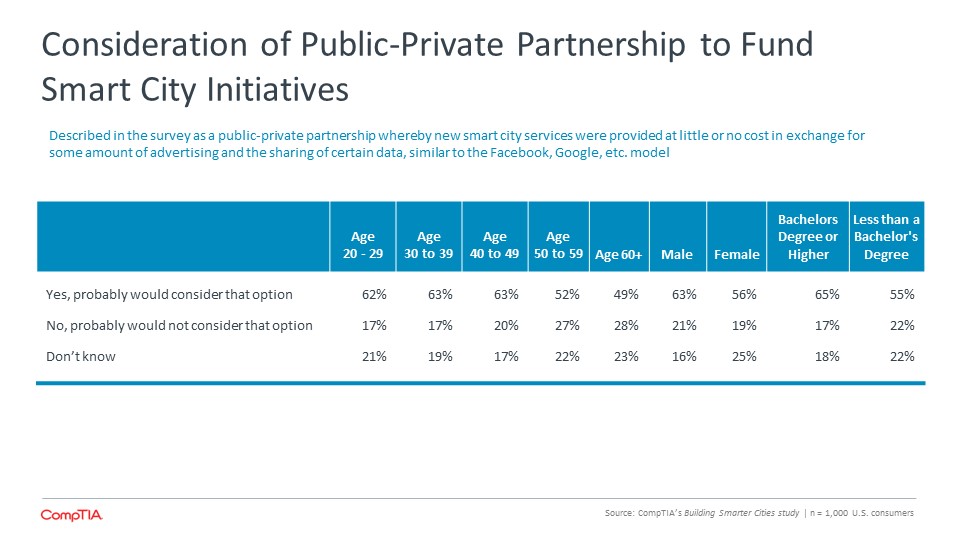

Intergovernmental cooperation and public-private partnerships

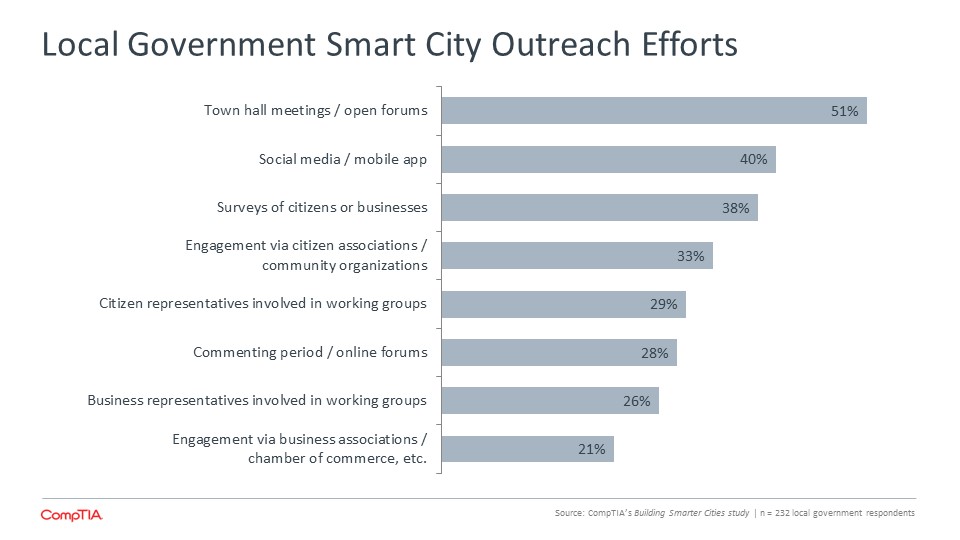

Nearly every conference in the smart cities space includes a session covering the importance of cooperation and partnerships. It’s probably safe to say that most stakeholders buy into these concepts, but the reality is, it’s often difficult to execute on mutually beneficial partnerships and cooperation. Even so, stakeholders will need to keep exploring ways to optimize information sharing, partnerships to enable creative co-funding or co-development models, joint community outreach strategies and more.

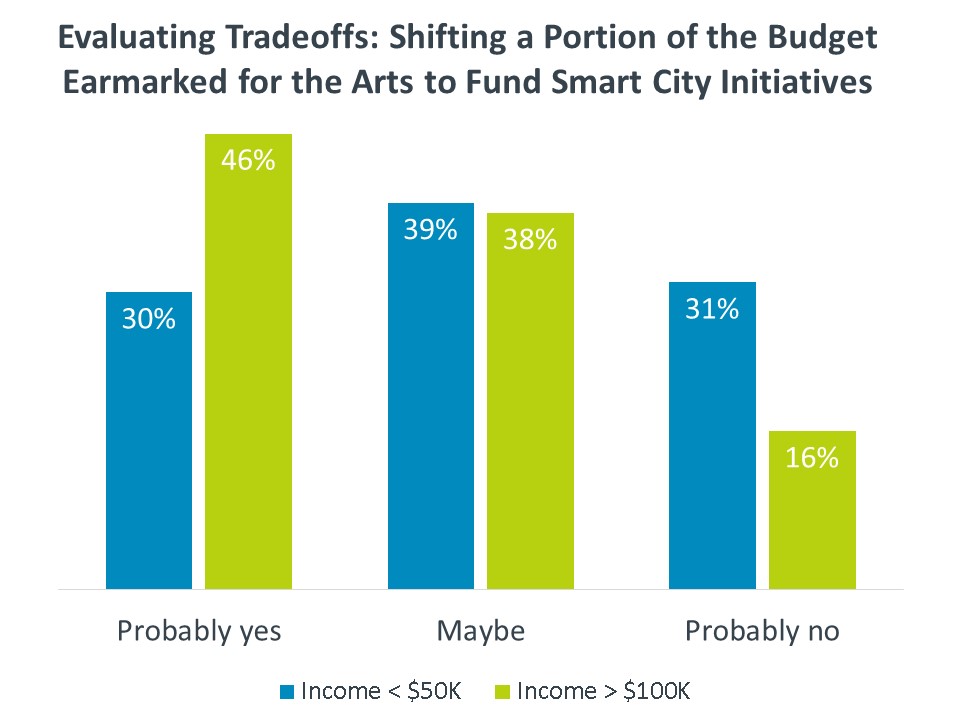

Digital divides

From the earliest days of technology, digital divides have been problematic. With the rise of e-government services and given the expected growth of smart cities, segments of society increasingly run the risk of not being able to fully engage needed services, employment opportunities, or community. This runs the spectrum of divides defined by incomes, age, rural vs. urban, ethnicity, and other characteristics. One data point from the research depicts the potential for differing opinions on assessing the value of smart city initiatives relative to the alternatives. Higher income households, with more options and access to the arts, appear more willing to consider shifting funding than lower income households, where publicly funded art is more important.

Appendix

Research Methodology

This quantitative study consisted of an online survey fielded to U.S. IT professionals during February 2017. A total of 300 IT businesses based in the United States participated in the survey, yielding an overall margin of sampling error proxy at 95% confidence of +/- 5.7 percentage points. Sampling error is larger for subgroups of the data.

As with any survey, sampling error is only one source of possible error. While non-sampling error cannot be accurately calculated, precautionary steps were taken in all phases of the survey design, collection and processing of the data to minimize its influence.

CompTIA is responsible for all content and analysis. Any questions regarding the study should be directed to CompTIA Research and Market Intelligence staff at [email protected].

CompTIA is a member of the market research industry’s Insights Association and adheres to its internationally respected Code of Standards.

ABOUT COMPTIA

The Computing Technology Industry Association (CompTIA) is a non-profit trade association serving as the voice of the information technology industry.

With approximately 2,000 member companies, 3,000 academic and training partners, 100,000 registered users and more than two million IT certifications issued, CompTIA is dedicated to advancing industry growth through educational programs, market research, networking events, professional certifications and public policy advocacy.

Useful resources

Research

CompTIA publishes 20+ studies per year, adding to an archive of more than 100 research reports, briefs, case studies, ecosystems, and more. Much of this content includes segmentations or analysis by company size and job role, and provides insights on various markets.

Education & Channel training

CompTIA has an extensive catalog of Quick Start Sessions, Executive Certificate Programs, Playbook Workshops, and Vender & Distributor Education. Many aspects of the training focus on sales and solutions for the SMB market.

COMMUNITIES

CompTIA member communities are forums for sharing best practices, collaborative problem solving, and mentoring. Discussions frequently revolve around the SMB market.

Read more about Technology Solutions.

Download Full PDF

Download Full PDF