Well past the infancy of cloud, most in today’s channel community have gotten their feet wet enough to gauge the true value of their cloud activities, whether minor or major in scope. The verdict? Generally good. Cloud, according to solution providers, has had a mostly positive effect on the channel and comprises a growing, if still small, slice of its overall business. And yet it continues to pose challenges to firms transitioning some or all of their business lines in this direction.

CompTIA’s 5th Annual Trends in Cloud Computing study reveals a channel community investing nearly across the board in cloud activities. We asked resellers, solution providers, MSPs and other channel types, and 9-in-10 firms reported cloud adoption in some fashion as part of their portfolio, up from 1-in-10 in 2010. Whether reluctantly dragged into the cloud world or starting there from birth, the channel’s leap in cloud participation demonstrates there’s no turning back. Download the study here.

Consider a few findings from the study:

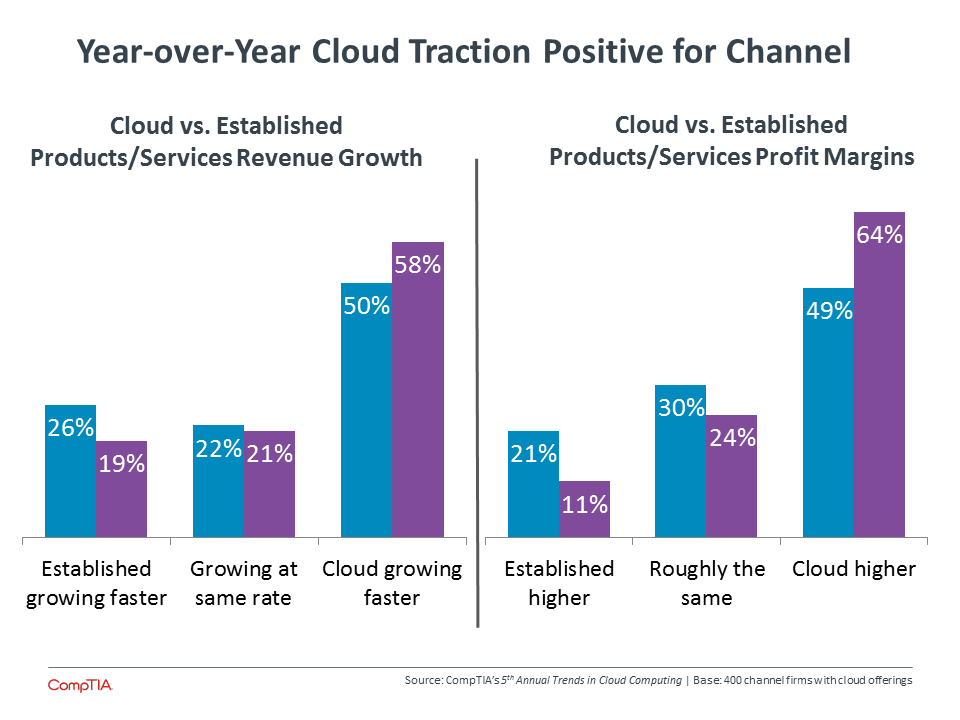

Compared with noncloud business offerings by channel firms, cloud solutions and services are growing faster in terms of revenue and delivering higher profit margins. And while that was also the case in 2013 based on the self-assessment of study respondents, the number reporting such positives for cloud activities jumped this year. This year, two-thirds of respondents reported higher profit margins on cloud business than noncloud, up from half last year. The revenue growth rate for cloud vs. noncloud solutions also shot up 8 percentage points from 2013.

About 4-in-10 respondents predicted cloud revenue to grow significantly (15 percent or more) in the coming year. That compares with 26 percent that responded similarly in 2013. This sunny outlook was shared consistently across all channel firm sizes, and regardless of the number of business model frameworks they participate in for cloud.

Channel firms also have more confidence in their abilities with cloud and the role it plays in their overall portfolio. About 57 percent of respondents described their cloud business as mature and strategic, compared with 46 percent with similar sentiment in 2013.

Reality Check

While there is much optimism around cloud today, there needs to be a reality check. For one, faster growth and higher margins do not necessarily mean that cloud is the main source of revenue for the vast majority of channel firms today. For most, it is not. And two, how cloud sales are accounted for vary firm by firm, with some tallying only solutions that are pure cloud, while other including any peripheral hardware or other infrastructure bundled into the sale. This can skew revenue and profit figures.

The research also suggests that increased experience with cloud brings growing pains. While the list of cloud-based challenges remains largely unchanged from years past, the number of respondents distinguishing these challenges as “very significant” rose by an average of about 10 percentage points across all items. Challenges include things like determining the correct business model, balancing cloud vs. noncloud businesses, initial costs and sales restructuring.

Likewise, 2-in-4 cloud business model frameworks for the channel saw diminished participation in the past year. The number of channel firms conducting work in the cloud enablement and integration space or management arena dipped in 2014. One possible explanation? Some of the channel firms that initially rushed into these markets may have found the work either exceeded their capacity to address while continuing to balance their legacy business or that the necessary resources to train or retrain staff on these services was too costly.

To read the full report, visit our Insights & Tools page.

Carolyn April is CompTIA’s senior director for industry analysis.